|

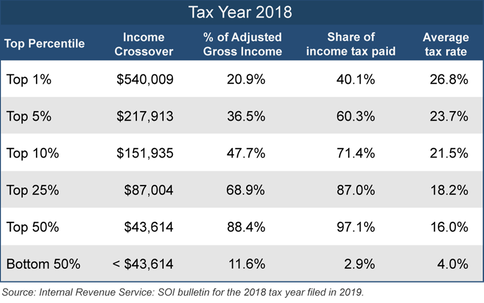

There will be a lot of political rhetoric about increasing the national debt with trillions more in spending, adding billions to allow the IRS to audit high income taxpayers, and creating more changes in the tax code in the next few months. To help you break through the media clutter, here is the latest information on who pays individual income taxes. The information comes directly from the IRS. It includes the latest published tax data for the 2018 tax year collected in 2019. It represents the first read on the impact of tax collections after implementation of the Tax Cuts and Jobs Act. While this time period is pre-COVID, it should give you an objective view of the current nature of the tax system without the impact of additional federal spending and the impact of unemployment due to the pandemic. How to read: The top 10% of Adjusted Gross Income (AGI) taxpayers reported approximately 47.7% of the income and paid 71.4% of the total individual income tax collected in 2019 for 2018 tax returns. Note: The above figures net out "negative" income tax returns for those who filed a tax return, but due to adjustments and credits have negative adjusted gross income. Source: Internal Revenue Service, SOI Bulletin - Selected Income and Tax Items, Shares of Adjusted Gross Income and Total Income Tax and Average Tax Rates. All figures are based on estimates from sampling conducted by the Internal Revenue Service using 2019 tax filing data that encompass 2018 tax returns. Income means Adjusted Gross Income (AGI) as reported on individual income tax returns. Observations

How to read the rhetoric Everyone should pay their fair share. It is an interesting phrase, but what does it mean? How much, exactly, is a fair share for upper income groups? The top 25% currently pay 87% of the tax. Should it be 90%? 95%? All of it? Conversely, are they talking about the 50% of taxpayers that are paying 3% of total income taxes? You will need to decide, but when applying the IRS statistics, it seems like word speak without substance. We have a progressive tax system. The IRS statistics noted above show this to be true. And even with the impact of the 2018 Tax Cuts and Jobs Act, the progressive nature of the system still holds true. Tax cuts favor the wealthy. Yes, tax cuts favor the wealthy because that's who currently pays the majority of income taxes. Tax increases also always hit higher income taxpayers...for the same reason. Part of the philosophical discussion surrounds the purpose of the income tax: is it to pay for spending or is it to redistribute wealth and convert income of some taxpayers into free and low cost benefits for others? Higher income taxes hurt small business. This is true, but perhaps in more ways than you think. Most small business tax payments are rolled into these individual income tax numbers. This is because most small businesses have their business profits taxed on their personal tax return as flow through entities. So changes in individual tax rates impact most small businesses which in turn impacts their ability to invest in their businesses and employees. To help solve this problem, the tax code contains a tax break called the qualified business income deduction. "Tax Tips" are published to provide current tax information, tax-cutting suggestions, and tax reminders. If you would like more information on anything in "Tax Tips," or if you'd like to be on our mailing list to receive other tax information from time to time, please contact our office. The tax information contained in this site is of a general nature and should not be acted upon in your specific situation without further details and/or professional assistance. We are trusted CPA advisors servicing Burr Ridge, Hinsdale, Willowbrook, Darien, Naperville, and all Chicagoland area. Do you need assistance with your business and/or personal tax returns? Would you like to have a trusted source for your accounting, allowing you additional time to focus on increasing your business? Do you use QuickBooks, or plan to in the future, for your accounting? We include these in all our service packages, customized to fit your personal or business needs. We are currently accepting new clients. Your initial consultation is free, so you have nothing to lose and everything to gain. Our experienced staff is available to help you streamline your accounting, giving you more free time for yourself. Set up an appointment today by calling (630) 320-3720 or email us at [email protected]. For more free resources, such as Tax Rates, Tax Organizers, and Record Retention Schedules, access our website www.monarchaccountinggroup.com. Monarch Accounting Group, Inc 145 Tower Drive, Suite 4 Burr Ridge, IL 60527 Phone (630) 320-3720

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

BLOGTo better serve our clients and friends, to keep you up-to-date and informed, our blog is a resource for tax tips and overall accounting related articles. We hope you find this useful! CATEGORIES

All

ARCHIVES

September 2023

|

|

Phone: (630) 320-3720

Monarch Accounting Group Inc 145 Tower Drive, Suite 10 Burr Ridge, IL 60527-7836 Email: [email protected] |

RSS Feed

RSS Feed