|

The IRS is more strictly enforcing rules that determine whether a worker is actually your employee, rather than an independent contractor.

So be careful if you regularly pay a gardener, housekeeper, nanny, babysitter or any other household service provider. You don't want to run afoul of the IRS's household employee rules, often referred to as the Nanny Tax. Do you have a household employee? Many taxpayers unwittingly establish an employer relationship when they hire someone to help around the house. To decide whether a household worker is your employee, the IRS looks at whether you:

The IRS also considers whether the relationship is permanent, and whether a worker is economically dependent on their employment with you. A worker may be considered an employee whether or not their work for you is part- or full-time, or paid hourly, weekly or by the job. Tip 1: The more independent the worker is, the less likely they are to be considered your employee. Have your worker set their own hours and use their own tools. Also have them invoice you for their work and provide you with receipts. Tip 2: If the worker works for another company that issues them a W-2, or they run their own company that offers services to the general public, you are generally safe from having them considered as your employee. Tax consequences If you think you have a household employee, here is what you need to know:

If you are going to rely heavily on the services of a domestic worker, it’s worth thinking carefully about the relationship at the outset. Consider getting a formal employment contract in place, and call for help to create a plan to handle your tax obligations. "Tax Tips" are published to provide current tax information, tax-cutting suggestions, and tax reminders. If you would like more information on anything in "Tax Tips," or if you'd like to be on our mailing list to receive other tax information from time to time, please contact our office. The tax information contained in this site is of a general nature and should not be acted upon in your specific situation without further details and/or professional assistance. We are trusted CPA advisors servicing Burr Ridge, Hinsdale, Willowbrook, Darien, Naperville, and all Chicagoland area. Do you need assistance with your business and/or personal tax returns? Would you like to have a trusted source for your accounting, allowing you additional time to focus on increasing your business? Do you use QuickBooks, or plan to in the future, for your accounting? We include these in all our service packages, customized to fit your personal or business needs. We are currently accepting new clients. Your initial consultation is free, so you have nothing to lose and everything to gain. Our experienced staff is available to help you streamline your accounting, giving you more free time for yourself. Set up an appointment today by calling (630) 320-3720 or email us at [email protected]. For more free resources, such as Tax Organizers, and Record Retention Schedules, access our website www.monarchaccountinggroup.com. Mia Verc, CPA; Janice Papais, CPA

0 Comments

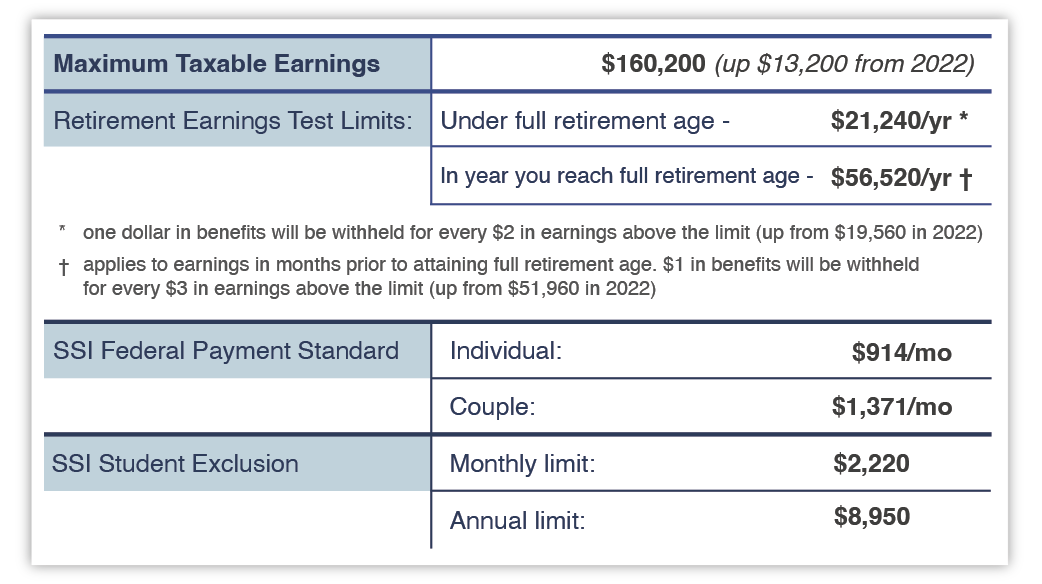

How much you pay and checks received are all going up!The Social Security Administration announced a whopping 8.7% boost to monthly Social Security and Supplemental Security Income (SSI) benefits for 2023. This is on the heels of a 5.9% increase last year. The increase is based on the rise in the Consumer Price Index over the past 12 months ending in September 2022. For those contributing to Social Security through wages, the potential maximum income subject to Social Security tax increases to $160,200. This represents a whopping 9% increase in your Social Security Tax! Here's a recap of the key dollar amounts: 2023 Social Security Benefits - Key Information What it means for you

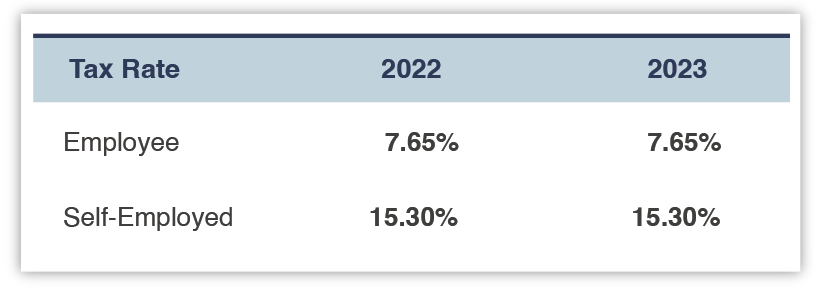

Social Security & Medicare Rates The Social Security and Medicare tax rates do not change from 2022 to 2023.

Note: The above tax rates are a combination of 6.20 percent Social Security and 1.45 percent for Medicare. There is also a 0.9 percent Medicare wages surtax for single taxpayers with wages above $200,000 ($250,000 for joint filers) that is not reflected in these figures. Please note that your employer also pays Social Security and Medicare taxes on your behalf. These figures are reflected in the self-employed tax rates, as self-employed individuals pay both halves of the tax. "Tax Tips" are published to provide current tax information, tax-cutting suggestions, and tax reminders. If you would like more information on anything in "Tax Tips," or if you'd like to be on our mailing list to receive other tax information from time to time, please contact our office. The tax information contained in this site is of a general nature and should not be acted upon in your specific situation without further details and/or professional assistance. We are trusted CPA advisors servicing Burr Ridge, Hinsdale, Willowbrook, Darien, Naperville, and all Chicagoland area. Do you need assistance with your business and/or personal tax returns? Would you like to have a trusted source for your accounting, allowing you additional time to focus on increasing your business? Do you use QuickBooks, or plan to in the future, for your accounting? We include these in all our service packages, customized to fit your personal or business needs. We are currently accepting new clients. Your initial consultation is free, so you have nothing to lose and everything to gain. Our experienced staff is available to help you streamline your accounting, giving you more free time for yourself. Set up an appointment today by calling (630) 320-3720 or email us at [email protected]. For more free resources, such as Tax Organizers, and Record Retention Schedules, access our website www.monarchaccountinggroup.com. Mia Verc, CPA; Janice Papais, CPA Action to take now!Now is a good time to assess your current situation and address those lingering tax moves that may improve your tax picture for 2022. Here are five things to consider:

1. Check on your withholdings. Review your taxable income and the amount of tax you’ve paid to Uncle Sam so far this year. How do the numbers compare to last year? Based on your analysis, you may have to adjust your paycheck withholdings or make estimated tax payments during the balance of the year to avoid underpayment penalties or a surprising tax bill. 2. Build up your retirement accounts. Don’t neglect your retirement savings during the remainder of the year. In fact, setting aside more money for retirement can lower this year’s tax bill. For instance, if you have a 401(k) plan at work, you can defer up to $20,500 of salary in 2022, plus an extra $6,500 if you’re age 50 or older. 3. Identify potential taxable events. It’s easy to overlook one-time events that will have an impact on your 2022 tax liability. For instance, if you win a prize at a church raffle, the prize is generally taxable to you. Perhaps you changed jobs, lost a child as a dependent, or got married. Each of these events can create a change in your tax obligation. Review your records now to avoid any unpleasant tax surprises later. 4. Consider business property needs. If you acquire business property, you can often choose to write off the cost in the first year the property is placed in service under the latest tax laws. If it makes sense, consider combining the benefits of the Section 179 expensing deduction, up to a maximum of $1 million (indexed for inflation), with 100% bonus depreciation for both new and used property. 5. Account for gig taxes. Finally, workers in the gig economy (like Uber and Lyft drivers) should understand the basic tax rules. Generally, income from such jobs is fully taxable, but you may be entitled to offsetting deductions. Essentially, you’re treated like a self-employed individual. Estimated quarterly tax payments are often required for these workers. Should you wish a review of your situation, call now. It's better to be prepared than surprised when it comes to your tax obligation. "Tax Tips" are published to provide current tax information, tax-cutting suggestions, and tax reminders. If you would like more information on anything in "Tax Tips," or if you'd like to be on our mailing list to receive other tax information from time to time, please contact our office. The tax information contained in this site is of a general nature and should not be acted upon in your specific situation without further details and/or professional assistance. We are trusted CPA advisors servicing Burr Ridge, Hinsdale, Willowbrook, Darien, Naperville, and all Chicagoland area. Do you need assistance with your business and/or personal tax returns? Would you like to have a trusted source for your accounting, allowing you additional time to focus on increasing your business? Do you use QuickBooks, or plan to in the future, for your accounting? We include these in all our service packages, customized to fit your personal or business needs. We are currently accepting new clients. Your initial consultation is free, so you have nothing to lose and everything to gain. Our experienced staff is available to help you streamline your accounting, giving you more free time for yourself. Set up an appointment today by calling (630) 320-3720 or email us at [email protected]. For more free resources, such as Tax Organizers, and Record Retention Schedules, access our website www.monarchaccountinggroup.com. Mia Verc, CPA; Janice Papais, CPA One of the best places for parents to look for tax savings If you're a parent, your dependent children can be a source of tax savings. There are the well-known provisions in the tax code such as the Dependent Child Care Credit and the Child Tax Credit, but there's also an opportunity to shift some taxable income to your children.

Shifting income to your children works because the tax rate increases as your income rises. This provides an incentive to shift income to your lower-earning dependent children. Here's how to make it work: Shifting income rules In 2022, the first $1,150 of unearned income for each child is not taxed and the next $1,150 in unearned income is taxed at the lowest rate of 10 percent. Typical unearned income includes interest, dividends, royalties and investment gains. Tip: Transfer enough income-producing assets to each child to approach the annual unearned income limits as closely as possible. Depending on your marginal tax rate you could be saving as much as 37 percent in federal income tax on the transferred amounts. Tip: In addition to the unearned income, consider purchasing investments that will have long-term capital gain appreciation. This may help manage the timing and rate of capital gains tax when the investment is later sold. Tip: Remember excess investment income could be subject to the additional 3.8% Medicare Surtax. Any investment income that can be shifted to your children could also save you this additional tax bite as well. Leverage your children's earned income Income your children make from wages is considered earned income. If you own a small business, finding ways to employ your children can be a way to shift income from your higher tax rate to their lower rate. Care must be taken to be able to defend the work being done by your child and the amount they receive for their work. Some ideas include:

Tip: If you are a sole proprietor, you may hire your dependent children under age 18 and won't be required to pay Social Security and Medicare taxes. Caution: Moving assets from you to your children could affect their ability to receive financial aid for college. Make sure to consider how your tax strategy affects college financing. There are many opportunities to leverage the tax advantages of having children. Reach out if you would like help creating a plan for your family. "Tax Tips" are published to provide current tax information, tax-cutting suggestions, and tax reminders. If you would like more information on anything in "Tax Tips," or if you'd like to be on our mailing list to receive other tax information from time to time, please contact our office. The tax information contained in this site is of a general nature and should not be acted upon in your specific situation without further details and/or professional assistance. We are trusted CPA advisors servicing Burr Ridge, Hinsdale, Willowbrook, Darien, Naperville, and all Chicagoland area. Do you need assistance with your business and/or personal tax returns? Would you like to have a trusted source for your accounting, allowing you additional time to focus on increasing your business? Do you use QuickBooks, or plan to in the future, for your accounting? We include these in all our service packages, customized to fit your personal or business needs. We are currently accepting new clients. Your initial consultation is free, so you have nothing to lose and everything to gain. Our experienced staff is available to help you streamline your accounting, giving you more free time for yourself. Set up an appointment today by calling (630) 320-3720 or email us at [email protected]. For more free resources, such as Tax Organizers, and Record Retention Schedules, access our website www.monarchaccountinggroup.com. Mia Verc, CPA; Janice Papais, CPA An IRS online account makes it easy for people to quickly get the tax planning info they need. With the same ease that taxpayers have when banking online or placing an online shopping order, they can log in and get the latest on their payment history, balance, and more.

Taxpayers can view information about their account including:

With an online account, taxpayers can also:

A taxpayer's balance will update no more than once every 24 hours, usually overnight. Taxpayers should also allow one to three weeks for payments to show in the payment history. Share this tip on social media -- #IRSTaxTip: An IRS online account is simple, safe, and secure. http://ow.ly/Kya150L19mF "Tax Tips" are published to provide current tax information, tax-cutting suggestions, and tax reminders. If you would like more information on anything in "Tax Tips," or if you'd like to be on our mailing list to receive other tax information from time to time, please contact our office. The tax information contained in this site is of a general nature and should not be acted upon in your specific situation without further details and/or professional assistance. We are trusted CPA advisors servicing Burr Ridge, Hinsdale, Willowbrook, Darien, Naperville, and all Chicagoland area. Do you need assistance with your business and/or personal tax returns? Would you like to have a trusted source for your accounting, allowing you additional time to focus on increasing your business? Do you use QuickBooks, or plan to in the future, for your accounting? We include these in all our service packages, customized to fit your personal or business needs. We are currently accepting new clients. Your initial consultation is free, so you have nothing to lose and everything to gain. Our experienced staff is available to help you streamline your accounting, giving you more free time for yourself. Set up an appointment today by calling (630) 320-3720 or email us at [email protected]. For more free resources, such as Tax Organizers, and Record Retention Schedules, access our website www.monarchaccountinggroup.com. Mia Verc, CPA; Janice Papais, CPA October extension deadline fast approachingMonday, October 17th marks the extension deadline for filing your 2021 Form 1040 tax return. Given all the recent tax legislation, numerous stimulus checks and COVID-related tax changes, there are more open tax return filings than ever!

If you have not filed a tax return and don't think you need to file one, please reconsider. Billions of refunds go unclaimed each year by taxpayers that really should file a tax return. Here's a quick checklist of situations when filing a tax return might make sense even if you don't have to:

Many taxpayers have trouble gathering accurate and complete information necessary to file their tax return. When they cannot get all the necessary information, they get stuck. Should this be your situation, please ask for help. Even a reasonably close tax filing that is later amended when more information becomes available is sometimes a better alternative than not filing at all. "Tax Tips" are published to provide current tax information, tax-cutting suggestions, and tax reminders. If you would like more information on anything in "Tax Tips," or if you'd like to be on our mailing list to receive other tax information from time to time, please contact our office. The tax information contained in this site is of a general nature and should not be acted upon in your specific situation without further details and/or professional assistance. We are trusted CPA advisors servicing Burr Ridge, Hinsdale, Willowbrook, Darien, Naperville, and all Chicagoland area. Do you need assistance with your business and/or personal tax returns? Would you like to have a trusted source for your accounting, allowing you additional time to focus on increasing your business? Do you use QuickBooks, or plan to in the future, for your accounting? We include these in all our service packages, customized to fit your personal or business needs. We are currently accepting new clients. Your initial consultation is free, so you have nothing to lose and everything to gain. Our experienced staff is available to help you streamline your accounting, giving you more free time for yourself. Set up an appointment today by calling (630) 320-3720 or email us at [email protected]. For more free resources, such as Tax Organizers, and Record Retention Schedules, access our website www.monarchaccountinggroup.com. Mia Verc, CPA; Janice Papais, CPA |

BLOGTo better serve our clients and friends, to keep you up-to-date and informed, our blog is a resource for tax tips and overall accounting related articles. We hope you find this useful! CATEGORIES

All

ARCHIVES

September 2023

|

|

Phone: (630) 320-3720

Monarch Accounting Group Inc 145 Tower Drive, Suite 10 Burr Ridge, IL 60527-7836 Email: [email protected] |

RSS Feed

RSS Feed