|

The IRS Non-filer Sign-up Tool offers a free and easy way for eligible people who don't normally have to file taxes to provide the IRS the basic information needed - name, address, and Social Security numbers – to figure and issue advance child tax credit payments. Often, these are individuals and families who receive little or no income, including those experiencing homelessness.

Here’s who should use this tool This tool is for people who did not file a tax return for 2019 or 2020 and did not use the IRS Non-filer tool last year to register for Economic Impact Payments. It enables them to provide required information about themselves, their qualifying children age 17 and under, their other dependents, and their direct deposit bank information so the IRS can quickly and easily deposit the payments directly into their checking or savings account. Here’s who should not use this tool Eligible families who already filed or plan to file 2019 or 2020 income tax returns should not use this tool. Once the IRS processes their 2019 or 2020 tax return, the information will be used to determine eligibility and issue advance payments. Families who want to claim other tax benefits, such as the earned income tax credit, should not use this tool. They should file a regular tax return. For them, the fastest and easiest way to file a return is the Free File system, available only on IRS.gov. About the advance child tax credit The expanded and newly-advanceable child tax credit was authorized by the American Rescue Plan Act, enacted in March. Normally, the IRS will calculate the payment based on a person's 2020 tax return, including those who use the Non-filer Sign-up tool. If that return has not yet been filed or is still being processed, the IRS will determine the initial payment amounts using the 2019 return or the information entered using the Non-filer tool that was available in 2020. The payment will be up to $300 per month for each child under age 6 and up to $250 per month for each child age 6 through 17. The IRS will issue these payments by direct deposit if correct banking information has been provided to the IRS. Otherwise, people should watch their mail around July 15 for their mailed payment. The dates for the advance child tax credit payments are July 15, Aug. 13, Sept. 15, Oct. 15, Nov. 15 and Dec. 15. See Advance Child Tax Credit Payments in 2021 on IRS.gov for details on eligibility and more helpful resources. The IRS asks community groups, non-profits, associations, education organizations and anyone else with connections to people with children to share this critical information about the advance child tax credit as well as other important benefits. "Tax Tips" are published to provide current tax information, tax-cutting suggestions, and tax reminders. If you would like more information on anything in "Tax Tips," or if you'd like to be on our mailing list to receive other tax information from time to time, please contact our office. The tax information contained in this site is of a general nature and should not be acted upon in your specific situation without further details and/or professional assistance. We are trusted CPA advisors servicing Burr Ridge, Hinsdale, Willowbrook, Darien, Naperville, and all Chicagoland area. Do you need assistance with your business and/or personal tax returns? Would you like to have a trusted source for your accounting, allowing you additional time to focus on increasing your business? Do you use QuickBooks, or plan to in the future, for your accounting? We include these in all our service packages, customized to fit your personal or business needs. We are currently accepting new clients. Your initial consultation is free, so you have nothing to lose and everything to gain. Our experienced staff is available to help you streamline your accounting, giving you more free time for yourself. Set up an appointment today by calling (630) 320-3720 or email us at [email protected]. For more free resources, such as Tax Rates, Tax Organizers, and Record Retention Schedules, access our website www.monarchaccountinggroup.com. Monarch Accounting Group, Inc 145 Tower Drive, Suite 4 Burr Ridge, IL 60527 Phone (630) 320-3720

0 Comments

The American Rescue plan increased the maximum Child Tax Credit amount in 2021 to $3,600 per child for children under the age of 6 and to $3,000 per child for children ages 6 through 17. It’s also now an advanceable payment, and automatic payments for eligible families will start on July 15, 2021. To help families sign up for this advanceable credit, the IRS launched several new online tools designed to help families manage and monitor these payments:

Tax credits for paid leave under the American Rescue Plan Act of 2021

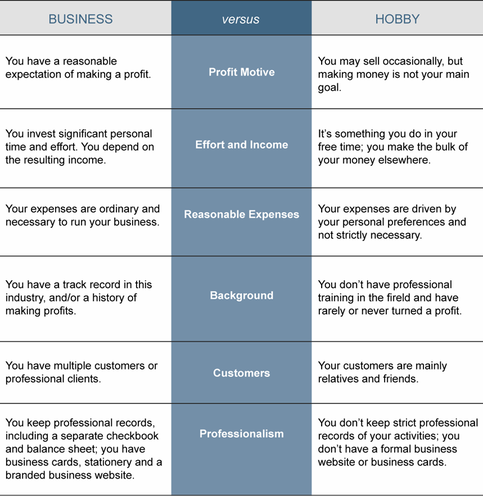

"Tax Tips" are published to provide current tax information, tax-cutting suggestions, and tax reminders. If you would like more information on anything in "Tax Tips," or if you'd like to be on our mailing list to receive other tax information from time to time, please contact our office. The tax information contained in this site is of a general nature and should not be acted upon in your specific situation without further details and/or professional assistance. We are trusted CPA advisors servicing Burr Ridge, Hinsdale, Willowbrook, Darien, Naperville, and all Chicagoland area. Do you need assistance with your business and/or personal tax returns? Would you like to have a trusted source for your accounting, allowing you additional time to focus on increasing your business? Do you use QuickBooks, or plan to in the future, for your accounting? We include these in all our service packages, customized to fit your personal or business needs. We are currently accepting new clients. Your initial consultation is free, so you have nothing to lose and everything to gain. Our experienced staff is available to help you streamline your accounting, giving you more free time for yourself. Set up an appointment today by calling (630) 320-3720 or email us at [email protected]. For more free resources, such as Tax Rates, Tax Organizers, and Record Retention Schedules, access our website www.monarchaccountinggroup.com. Monarch Accounting Group, Inc 145 Tower Drive, Suite 4 Burr Ridge, IL 60527 Phone (630) 320-3720  You’ve loved dogs all your life so you decide to start a dog training business. Turning your hobby into a business can provide tax benefits if you do it right. But it can create a big tax headache if you do it wrong. One of the main benefits of turning your hobby into a business is that you can deduct all your qualified business expenses, even if it results in a loss. However, if you don’t properly transition your hobby into a business in the eyes of the IRS, you could be in line for an audit. The agency uses several criteria to distinguish whether an activity is a hobby or a business. Check the chart below to see how your activity measures up. The business-versus-hobby test

If your dog training business (or any other activity) falls under any of the hobby categories on the right side of the chart, consider what you can do to meet the business-like criteria on the left side. The more your activity resembles the left side, the less likely you are to be challenged by the IRS. On the other hand, if you determine that you’re really engaged in a hobby, there are still some tax benefits to be had. You can treat hobby expenses as a miscellaneous itemized deduction on a tax return, but generally not more than hobby income. They can be used to reduce taxable income if they and other miscellaneous expenses surpass 2 percent of your adjusted gross income. If you need help to ensure you meet the IRS’s criteria for businesslike activity, reach out to schedule an appointment. "Tax Tips" are published to provide current tax information, tax-cutting suggestions, and tax reminders. If you would like more information on anything in "Tax Tips," or if you'd like to be on our mailing list to receive other tax information from time to time, please contact our office. The tax information contained in this site is of a general nature and should not be acted upon in your specific situation without further details and/or professional assistance. We are trusted CPA advisors servicing Burr Ridge, Hinsdale, Willowbrook, Darien, Naperville, and all Chicagoland area. Do you need assistance with your business and/or personal tax returns? Would you like to have a trusted source for your accounting, allowing you additional time to focus on increasing your business? Do you use QuickBooks, or plan to in the future, for your accounting? We include these in all our service packages, customized to fit your personal or business needs. We are currently accepting new clients. Your initial consultation is free, so you have nothing to lose and everything to gain. Our experienced staff is available to help you streamline your accounting, giving you more free time for yourself. Set up an appointment today by calling (630) 320-3720 or email us at [email protected]. For more free resources, such as Tax Rates, Tax Organizers, and Record Retention Schedules, access our website www.monarchaccountinggroup.com. Monarch Accounting Group, Inc 145 Tower Drive, Suite 4 Burr Ridge, IL 60527 Phone (630) 320-3720 Now is the time to make your estimated tax payment

If you have not already done so, now is the time to review your tax situation and make an estimated quarterly tax payment using Form 1040-ES. The second quarter due date is now here. Due date: Tuesday, June 15, 2021 You are required to withhold at least 90 percent of your 2021 tax obligation or 100 percent of your 2020 tax obligation.* A quick look at your 2020 tax return and a projection of your 2021 tax obligation can help determine if a payment is necessary. Here are some other things to consider:

* If your income is over $150,000 ($75,000 if married filing separate), you must pay 110 percent of your 2020 tax obligation to avoid an underpayment penalty. "Tax Tips" are published to provide current tax information, tax-cutting suggestions, and tax reminders. If you would like more information on anything in "Tax Tips," or if you'd like to be on our mailing list to receive other tax information from time to time, please contact our office. The tax information contained in this site is of a general nature and should not be acted upon in your specific situation without further details and/or professional assistance. We are trusted CPA advisors servicing Burr Ridge, Hinsdale, Willowbrook, Darien, Naperville, and all Chicagoland area. Do you need assistance with your business and/or personal tax returns? Would you like to have a trusted source for your accounting, allowing you additional time to focus on increasing your business? Do you use QuickBooks, or plan to in the future, for your accounting? We include these in all our service packages, customized to fit your personal or business needs. We are currently accepting new clients. Your initial consultation is free, so you have nothing to lose and everything to gain. Our experienced staff is available to help you streamline your accounting, giving you more free time for yourself. Set up an appointment today by calling (630) 320-3720 or email us at [email protected]. For more free resources, such as Tax Rates, Tax Organizers, and Record Retention Schedules, access our website www.monarchaccountinggroup.com. Monarch Accounting Group, Inc 145 Tower Drive, Suite 4 Burr Ridge, IL 60527 Phone (630) 320-3720  The tax filing due date often brings a sigh of relief to most taxpayers. Unfortunately, every tax day also closes the window on the ability to claim a refund. According to the IRS, in 2017 up to 1.4 million individuals representing $1.35 billion in unclaimed refunds had this money turned over to the U.S. Treasury this past tax day. As unlikely as this sounds, losing a refund could happen to you or someone you know. The Causes You may be due a refund beyond your tax liability. While most tax credits can be used to reduce your tax liability down to zero, there are a few credits that allow you to receive money beyond the amount of your tax liability. The most common examples of these refundable credits are the Earned Income Tax Credit, the American Opportunity Tax Credit and the Child Tax Credit. Taxpayers often fail to take advantage of these refundable credits because they assume since they owe no tax they are not entitled to a refund. Part-time workers often lose refunds. Students and part-time workers are often the innocent victims of employer payroll systems. Payroll systems might assume you are working full-time and withhold pay from your wages at too high a rate. While some part-time workers may owe no tax, these excess withholdings are only returned to you in the form of a refund when you file a tax return. Seniors can also be victims. The same situation happens to seniors that have money withheld from their retirement fund disbursements and Social Security checks. Their income is often low enough to not require filing a tax return. When withholdings are involved, the non-filing of a tax return could lead to a lost refund. Death and disability create tax-filing confusion. When the person who normally organizes and files taxes for the family becomes disabled or passes away, there's a possibility that timely filing of tax returns gets missed. I need to be perfect. A number of taxpayers do not file on time because they are missing a piece of information. The dilemma of needing to be 100% accurate before filing your tax return can be debilitating. This concern often creates non-filed tax returns and lost refunds. Economic impact payment confusion. With multiple rounds of stimulus checks approved by Congress, it can be difficult to keep track of them to ensure you receive your payments and that the payment amounts are correct. This is especially true if you do not normally have to file a tax return. What you can do You have three years. You have the later of three years from the original filing due date or two years from the time you paid any tax to claim your refund or file an amended tax return. This timeline is strictly enforced by the IRS. If you miss the deadline by even one day, you could be out of luck. For most of us this means tax years 2018, 2019, and 2020 are still open for refund requests by filing a tax return or amending a tax return filed in error. Non-filer double check. If you did not file a tax return because you did not think it was necessary, conduct a review of your W-2's, 1099's and other documentation. If there is money withheld, ask for assistance to see if a refund is possible. Check out the Recovery Rebate Credit. If you did not receive economic impact payments, and did not file a tax return, the IRS offers free options to prepare and file information to receive payment on how to file at www.irs.gov. Thankfully, there are a few exceptions to these deadlines for bad debt, worthless securities, and for those unable to manage their financial affairs. But do not count on this as a fall back. If you had money withheld or if your tax return filing is not current, you could possibly be a victim of lost refunds. Now is the time to take action for 2018 thru 2020. "Tax Tips" are published to provide current tax information, tax-cutting suggestions, and tax reminders. If you would like more information on anything in "Tax Tips," or if you'd like to be on our mailing list to receive other tax information from time to time, please contact our office. The tax information contained in this site is of a general nature and should not be acted upon in your specific situation without further details and/or professional assistance. We are trusted CPA advisors servicing Burr Ridge, Hinsdale, Willowbrook, Darien, Naperville, and all Chicagoland area. Do you need assistance with your business and/or personal tax returns? Would you like to have a trusted source for your accounting, allowing you additional time to focus on increasing your business? Do you use QuickBooks, or plan to in the future, for your accounting? We include these in all our service packages, customized to fit your personal or business needs. We are currently accepting new clients. Your initial consultation is free, so you have nothing to lose and everything to gain. Our experienced staff is available to help you streamline your accounting, giving you more free time for yourself. Set up an appointment today by calling (630) 320-3720 or email us at [email protected]. For more free resources, such as Tax Rates, Tax Organizers, and Record Retention Schedules, access our website www.monarchaccountinggroup.com. Monarch Accounting Group, Inc 145 Tower Drive, Suite 4 Burr Ridge, IL 60527 Phone (630) 320-3720  If you receive a notice from the IRS, do not automatically assume it is correct and submit payment to make it go away. Because of all the recent tax law changes and so little time to implement the changes, the IRS can be wrong more often than you think. These IRS letters, called correspondent audits, need to be taken seriously, but not without undergoing a solid review. So what should you do if you receive one? Stay calm. Try not to over-react to the correspondence. This is easier said than done, but remember that the IRS sends out millions of these types of correspondence each year. The vast majority of them correct simple oversights or common filing errors. Open the envelope! You would be surprised how often taxpayers are so stressed by receiving a letter from the IRS that they cannot bear to open the envelope. If you fall into this category, try to remember that the first step in making the problem go away is to open the correspondence. Conduct a careful review. Review the letter. Understand exactly what the IRS is telling you needs changed and determine whether or not you agree with their findings. The IRS rarely sends correspondence to correct an oversight in your favor, but sometimes it happens. Respond timely. The IRS will tell you what it believes you should do and within what time frame. Ignore this information at your own risk. Delays in responses could generate penalties and additional interest payments. Get Help. You are not alone. Getting assistance from someone who deals with this all the time makes the process go much smoother. Correct the IRS error. Once the problem is understood, a clearly written response with copies of documentation will cure most of these IRS correspondence errors. Often the error is due to the inability of the IRS computers to conduct a simple reporting match. Pointing out the information on your tax return might be all it takes to solve the problem. Certified mail is your friend. Any responses to the IRS should be sent via certified mail or other means that clearly show you replied to their inquiry before the IRS's deadline This will provide proof of your timely correspondence. Lost mail can lead to delays, penalties, and additional interest tacked on to your tax bill. Don't assume it will go away. Until receiving definitive confirmation that the problem has been resolved, you need to assume the IRS still thinks you owe the money. If no correspondence confirming the correction is received, a written follow-up to the IRS will be required. "Tax Tips" are published to provide current tax information, tax-cutting suggestions, and tax reminders. If you would like more information on anything in "Tax Tips," or if you'd like to be on our mailing list to receive other tax information from time to time, please contact our office. The tax information contained in this site is of a general nature and should not be acted upon in your specific situation without further details and/or professional assistance. We are trusted CPA advisors servicing Burr Ridge, Hinsdale, Willowbrook, Darien, Naperville, and all Chicagoland area. Do you need assistance with your business and/or personal tax returns? Would you like to have a trusted source for your accounting, allowing you additional time to focus on increasing your business? Do you use QuickBooks, or plan to in the future, for your accounting? We include these in all our service packages, customized to fit your personal or business needs. We are currently accepting new clients. Your initial consultation is free, so you have nothing to lose and everything to gain. Our experienced staff is available to help you streamline your accounting, giving you more free time for yourself. Set up an appointment today by calling (630) 320-3720 or email us at [email protected]. For more free resources, such as Tax Rates, Tax Organizers, and Record Retention Schedules, access our website www.monarchaccountinggroup.com. Monarch Accounting Group, Inc 145 Tower Drive, Suite 4 Burr Ridge, IL 60527 Phone (630) 320-3720 |

BLOGTo better serve our clients and friends, to keep you up-to-date and informed, our blog is a resource for tax tips and overall accounting related articles. We hope you find this useful! CATEGORIES

All

ARCHIVES

September 2023

|

|

Phone: (630) 320-3720

Monarch Accounting Group Inc 145 Tower Drive, Suite 10 Burr Ridge, IL 60527-7836 Email: [email protected] |

RSS Feed

RSS Feed