|

At the end of the year you will be inundated with commercials to donate a vehicle to charity. While it is one of the biggest contributions a taxpayer can make, if not done carefully, the tax deduction of a donated vehicle could be a lot lower than you think.

The rule When you donate a vehicle, the value of your donation is either the fair market value of your vehicle when you donate it OR the value received by the charitable organization for your donation. Unfortunately, you do not choose the value of the donated vehicle.

What you should do Select the organization wisely. Select an organization that will either use the vehicle themselves or will use it to train others. Examples of qualified organizations include groups that help single mothers obtain transportation to and from work or use the vehicles to deliver meals to seniors. Other organizations teach auto repair and body shop work to the unemployed. The cars then are given to other non-profits or needy folks. From the IRS perspective, a qualifying charitable use either;

Special Caution: Be aware of national advertisers like KARZ4KIDS..they almost always limit your donation amount by what they can resell your car for...often below the fair market value. And before donating, know how, and be pleased with how, the funds are to be used. Research the fair market value: Prior to donating your vehicle go to a reputable source and estimate the value of your vehicle. Online resources like Edmunds.com and kbb.com (Kelley Blue Book) are two reliable sites to do this. Also make a copy of your title and take pictures of your car prior to donating it to the charity to help support your fair market value claim. Obtain the proper tax form. When donating your vehicle make sure the organization gives you a proper Form 1098-C at the time you provide your vehicle. Double check the value assigned to your donation form to ensure it meets or exceeds the estimated fair market value of your donation. Remember, if your valuation exceeds $5,000 you will need an approved appraisal. Sell the vehicle and donate the cash: If you cannot find a charitable organization that will allow you to maximize your fair market value deduction, consider selling the vehicle and then donating the proceeds. There is a potential problem with this approach, however. Take care that you do not create an unplanned taxable capital gain with the transaction. Note: These rules apply to other vehicle donations as well. This includes motorcycles, trucks, vans, buses, RV's and other transportation vehicles. "Tax Tips" are published to provide current tax information, tax-cutting suggestions, and tax reminders. If you would like more information on anything in "Tax Tips," or if you'd like to be on our mailing list to receive other tax information from time to time, please contact our office. The tax information contained in this site is of a general nature and should not be acted upon in your specific situation without further details and/or professional assistance. We are trusted CPA advisors servicing Burr Ridge, Hinsdale, Willowbrook, Darien, Naperville, and all Chicagoland area.

0 Comments

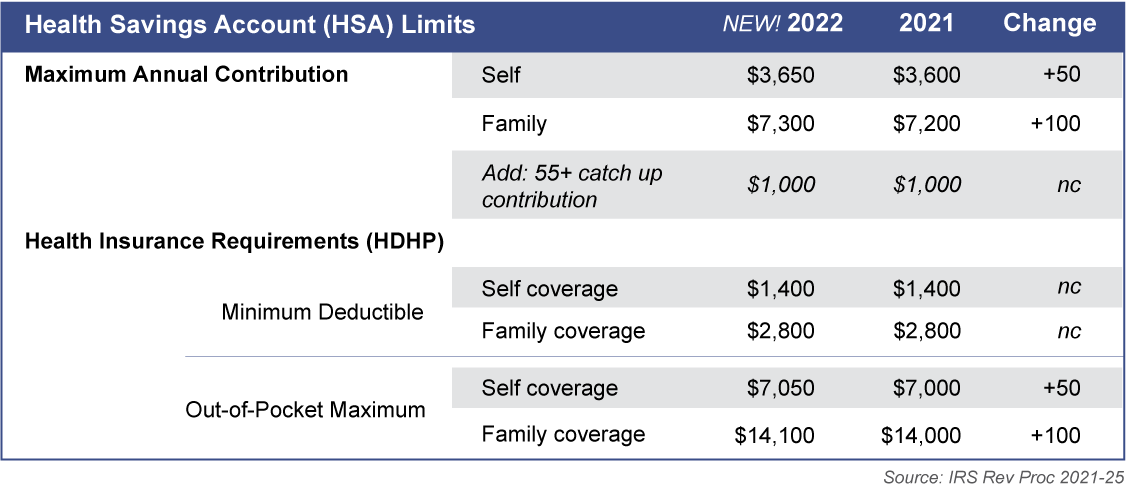

The savings limits for the ever-popular health savings accounts (HSA) are set for 2022. The new limits are outlined here with current year amounts noted for comparison. So plan now for your contributions. What is an HSA? An HSA is a tax-advantaged savings account whose funds can be used to pay qualified health care costs for you, your spouse and your dependents. The account is a great way to pay for qualified health care costs with pre-tax dollars. In fact any investment gains on your funds are also tax-free as long as they are used to pay for qualified medical, dental or vision expenses. Unused funds may be carried over from one year to the next. To qualify for this tax-advantaged account you must be enrolled in a high-deductible health plan (HDHP). The limits Note: An HDHP plan has minimum deductible requirements that are typically higher than traditional health insurance plans. To qualify for an HSA, your coverage must have out-of-pocket payment limits in line with the maximums noted above.

The key is to maximize funds to pay for your medical, dental, and vision care expenses with pre-tax money. By building your account now, you could have a next egg for unforeseen future expenses. "Tax Tips" are published to provide current tax information, tax-cutting suggestions, and tax reminders. If you would like more information on anything in "Tax Tips," or if you'd like to be on our mailing list to receive other tax information from time to time, please contact our office. The tax information contained in this site is of a general nature and should not be acted upon in your specific situation without further details and/or professional assistance. We are trusted CPA advisors servicing Burr Ridge, Hinsdale, Willowbrook, Darien, Naperville, and all Chicagoland area. Next year taxpayers can put an extra $1,000 into their 401(k) plans. The IRS recently announced that the 2022 contribution limit for 401(k) plans will increase to $20,500. The agency also announced cost‑of‑living adjustments that may affect pension plan and other retirement-related savings next year.

Highlights of changes for 2022 The contribution limit for employees who participate in 401(k), 403(b), most 457 plans, and the federal government's Thrift Savings Plan is increased to $20,500. Limits on contributions to traditional and Roth IRAs remains unchanged at $6,000. Taxpayers can deduct contributions to a traditional IRA if they meet certain conditions. If neither the taxpayer nor their spouse is covered by a retirement plan at work, their full contribution to a traditional IRA is deductible. If the taxpayer or their spouse was covered by a retirement plan at work, the deduction may be reduced or phased out until it is eliminated. The amount of the deduction depends on the taxpayer's filing status and their income. Traditional IRA income phase-out ranges for 2022 are:

Roth IRA contributions income phase-out ranges for 2022 are:

Saver’s Credit income phase-out ranges for 2022 are:

The amount individuals can contribute to SIMPLE retirement accounts also increases to $14,000 in 2022. More information: Notice 2021-61 Roth IRAs Traditional IRAs Traditional and Roth IRAs — A comparison chart Publication 590-A, Contributions to Individual Retirement Arrangements COLA Increases for Dollar Limitations on Benefits and Contributions "Tax Tips" are published to provide current tax information, tax-cutting suggestions, and tax reminders. If you would like more information on anything in "Tax Tips," or if you'd like to be on our mailing list to receive other tax information from time to time, please contact our office. The tax information contained in this site is of a general nature and should not be acted upon in your specific situation without further details and/or professional assistance. We are trusted CPA advisors servicing Burr Ridge, Hinsdale, Willowbrook, Darien, Naperville, and all Chicagoland area. As taxpayers get ready for the upcoming filing season, It’s important for them to know their correct filing status. A taxpayer’s filing status defines the type of tax return form they should use when filing their taxes. Filing status can affect the amount of tax they owe, and it may even determine if they have to file a tax return at all.

There are five IRS filing statuses. They generally depend on the taxpayer’s marital status as of Dec.31. However, more than one filing status may apply in certain situations. If this is the case, taxpayers can usually choose the filing status that allows them to pay the least amount of tax. When preparing and filing a tax return, the filing status affects:

Here are the five filing statuses:

More Information: Publication 501, Dependents, Standard Deduction and Filling Information Share this tip on social media -- #IRSTaxTip: Why it’s important that taxpayers know and understand their correct filing status. https://go.usa.gov/xeBgM "Tax Tips" are published to provide current tax information, tax-cutting suggestions, and tax reminders. If you would like more information on anything in "Tax Tips," or if you'd like to be on our mailing list to receive other tax information from time to time, please contact our office. The tax information contained in this site is of a general nature and should not be acted upon in your specific situation without further details and/or professional assistance. We are trusted CPA advisors servicing Burr Ridge, Hinsdale, Willowbrook, Darien, Naperville, and all Chicagoland area. As taxpayers get ready for the upcoming filing season, It’s important for them to know their correct filing status. A taxpayer’s filing status defines the type of tax return form they should use when filing their taxes. Filing status can affect the amount of tax they owe, and it may even determine if they have to file a tax return at all.

There are five IRS filing statuses. They generally depend on the taxpayer’s marital status as of Dec.31. However, more than one filing status may apply in certain situations. If this is the case, taxpayers can usually choose the filing status that allows them to pay the least amount of tax. When preparing and filing a tax return, the filing status affects:

Here are the five filing statuses:

More Information: Publication 501, Dependents, Standard Deduction and Filling Information "Tax Tips" are published to provide current tax information, tax-cutting suggestions, and tax reminders. If you would like more information on anything in "Tax Tips," or if you'd like to be on our mailing list to receive other tax information from time to time, please contact our office. The tax information contained in this site is of a general nature and should not be acted upon in your specific situation without further details and/or professional assistance. We are trusted CPA advisors servicing Burr Ridge, Hinsdale, Willowbrook, Darien, Naperville, and all Chicagoland area. Roll it Before You Pull it Tips to avoid IRS penalties on 401(k) retirement plan distributions11/15/2021 While each retirement plan has similar early withdrawal penalty exemptions, they are not all alike. Knowing these subtle differences within 401(k) plans can help you avoid a 10 percent tax penalty if you take money out of the plan prior to reaching age 59 1/2. This is true because a basic rollover of funds into a Traditional IRA is a readily available option to avoid the penalty. You should consider rolling over your 401(k) into an IRA prior to early distribution when:

Remember, by rolling the funds prior to pulling the funds for pre-retirement distribution you are avoiding the early withdrawal penalties, but you must still pay the applicable income tax. Bonus Retirement Plan Tips Two other quirks in the retirement tax code to be aware of:

"Tax Tips" are published to provide current tax information, tax-cutting suggestions, and tax reminders. If you would like more information on anything in "Tax Tips," or if you'd like to be on our mailing list to receive other tax information from time to time, please contact our office. The tax information contained in this site is of a general nature and should not be acted upon in your specific situation without further details and/or professional assistance. We are trusted CPA advisors servicing Burr Ridge, Hinsdale, Willowbrook, Darien, Naperville, and all Chicagoland area. retending to be an IRS agent is one of the favorite tactics of scam artists, according to the Better Business Bureau. The con artists impersonate the IRS to either intimidate people into making payments over the phone, or to send misleading emails tricking people into sharing personal information digitally.

You can defend yourself against these scammers by knowing these simple rules: Tip 1: Expect a letter first In almost every case, the IRS will send you a letter via standard mail if they need to get in touch with you. This will alert you to expect future communication from the agency and instruct you on the best ways to get in touch with them. What to do: If you get a letter from the IRS that is unexpected or suspicious, it should have a form or notice number searchable on the IRS website, www.irs.gov. If something doesn't look right, you can call the IRS help desk at 1-800-829-1040 to question it. Tip 2: Never over email The IRS will never initiate contact with you using email. A common scammer trick is to send emails to taxpayers using accounts and graphics that imitate the agency's logo. These emails may threaten imprisonment or fines if you don't pay up, or promise an extra refund if you send money to "prepay" your taxes. Often the emails contain links to an official-looking fake website to collect payments. Clicking on them may also trigger the installation of virus programs on your computer. What to do: Don't respond to any email communications supposedly from the IRS. Don't click on any links. Delete the email or forward it to [email protected] to help catch the scammers. Tip 3: Proper phone call etiquette After notification via the USPS, the real IRS may call to discuss options for handling delinquent taxes or an audit. A real IRS agent or a debt collector won't demand immediate payment without giving you an opportunity to question or appeal the bill. Nor will they threaten lawsuits, arrest or deportation. Their tone should not be hostile or insulting. Finally, if they ask for payment, they should be asking you to make payments only to the United States Treasury. What to do: If you get a call from the IRS or an IRS debt collector, politely ask for the employee's name, badge number and phone number. They shouldn't hesitate to provide this information. You should then end the call and dial the IRS at 1-800-366-4484 to confirm the person's identity. Tip 4: Check in-person visits Ask the person for their credentials. Every IRS agent is able to produce two forms of credentials: a pocket commission card and a personal identity verification card issued by the Department of Homeland Security, also called an HSPD-12. What to do: Never provide sensitive information nor confirm information they may have without first independently verifying they are legitimate representatives of the IRS. If you have concerns, call the IRS at 1-800-366-4484 to confirm the person's identity. You do not need to navigate this problem on your own. Call immediately for assistance. It is good to have a knowledgeable expert on your side. "Tax Tips" are published to provide current tax information, tax-cutting suggestions, and tax reminders. If you would like more information on anything in "Tax Tips," or if you'd like to be on our mailing list to receive other tax information from time to time, please contact our office. The tax information contained in this site is of a general nature and should not be acted upon in your specific situation without further details and/or professional assistance. We are trusted CPA advisors servicing Burr Ridge, Hinsdale, Willowbrook, Darien, Naperville, and all Chicagoland area. With all the tax law changes over the past few years, here are some things that should trigger you to conduct a full tax planning session to ensure your tax bill is not higher than it needs to be.

1. You owed tax in 2020. Having a surprising tax bill is never fun. So if you owed taxes last year, project your current year obligation if you have not already done so. 2. Your household income is over $150,000 single and $200,000 joint. As your income grows, so does your tax bill. This occurs because tax rates increase, and tax benefits phase out. This includes things like; lower child tax credit amounts, increases in capital gains tax rates, higher income tax rates, Medicare surtaxes plus more. 3. You are getting married or divorced. The tax penalty for being married is higher than ever. Are you prepared? 4. You have kids attending college next year. There are a number of tax programs that can help, you may wish to review your options and their impact on your tax return. 5. You have a small business. There are depreciation benefits, qualified business deductions, and numerous small business tax credits to consider. A review is especially important if you have a business that is a flow through entity like Sub Chapter S or LLC companies as these entities are taxed on your personal tax return.. 6. You plan on selling investments. Capital Gains tax rates can now range from 0% to 37% (or even higher with the Net Investment Tax). 7. There are changes in your employer provided benefits. These changes could impact your taxable income this year. 8. You buy, sell or go through home foreclosure. There are great tax benefits within your home, but only if you know about them and plan accordingly. 9. You have major medical expenses. It is harder than ever to itemize deductions, but one way it possible to itemize is if you have a major medical expense. When this happens it is time to review ALL itemized deductions to minimize your taxes. 10. You recently lost or changed jobs. Understanding the tax impact of unemployment benefits is crucial. 11. You have not conducted a tax withholding review. To avoid under withholding penalties, you need to ensure your withholdings are sufficient. 12. Your estate has not been reviewed in the past 12 months. Recently passed estate laws and potential changes in these rules make an annual review a must. If any of these triggers apply to you, please schedule a tax planning appointment. "Tax Tips" are published to provide current tax information, tax-cutting suggestions, and tax reminders. If you would like more information on anything in "Tax Tips," or if you'd like to be on our mailing list to receive other tax information from time to time, please contact our office. The tax information contained in this site is of a general nature and should not be acted upon in your specific situation without further details and/or professional assistance. We are trusted CPA advisors servicing Burr Ridge, Hinsdale, Willowbrook, Darien, Naperville, and all Chicagoland area. |

BLOGTo better serve our clients and friends, to keep you up-to-date and informed, our blog is a resource for tax tips and overall accounting related articles. We hope you find this useful! CATEGORIES

All

ARCHIVES

September 2023

|

|

Phone: (630) 320-3720

Monarch Accounting Group Inc 145 Tower Drive, Suite 10 Burr Ridge, IL 60527-7836 Email: [email protected] |

RSS Feed

RSS Feed