|

During the holiday season, taxpayers should be aware of gift card scams thieves commonly use this time of year. Con artists will target taxpayers by asking them to pay a fake tax bill with gift cards. They may also use a compromised email account to send emails requesting gift card purchases for friends, family or co-workers.

This scam is easy to avoid if taxpayers remember that the IRS never asks for or accepts gift cards as payment for a tax bill. Here's how this scam usually happens:

Here's how taxpayers can tell if it's really the IRS calling. The IRS will never:

Any taxpayer who believes they've been targeted by a scammer should:

Report threatening or harassing telephone calls claiming to be from the IRS to [email protected]. People should include "IRS phone scam" in the subject line "Tax Tips" are published to provide current tax information, tax-cutting suggestions, and tax reminders. If you would like more information on anything in "Tax Tips," or if you'd like to be on our mailing list to receive other tax information from time to time, please contact our office. The tax information contained in this site is of a general nature and should not be acted upon in your specific situation without further details and/or professional assistance. We are trusted CPA advisors servicing Burr Ridge, Hinsdale, Willowbrook, Darien, Naperville, and all Chicagoland area. Do you need assistance with your business and/or personal tax returns? Would you like to have a trusted source for your accounting, allowing you additional time to focus on increasing your business? Do you use QuickBooks, or plan to in the future, for your accounting? We include these in all our service packages, customized to fit your personal or business needs. We are currently accepting new clients. Your initial consultation is free, so you have nothing to lose and everything to gain. Our experienced staff is available to help you streamline your accounting, giving you more free time for yourself. Set up an appointment today by calling (630) 320-3720 or email us at [email protected]. For more free resources, such as Tax Organizers, and Record Retention Schedules, access our website www.monarchaccountinggroup.com. Mia Verc, CPA; Janice Papais, CPA

0 Comments

Before 2022 comes to a close, take some time to review these essential items to ensure you are not missing something that could cause tax trouble when you file your tax return:

1. Take required minimum distributions (RMDs). If you are age 72 or older, you need to take RMDs from certain retirement accounts before Dec. 31st to avoid a 50% penalty! This includes most IRAs (except Roth IRAs) and 401(k)s. Your annual RMD is calculated by dividing the prior Dec. 31st balance by the life expectancy factor provided by IRS tables. 2. Watch for your Identity Protection PIN from the IRS. If you are a victim of tax-related identity theft, the IRS will mail you a one-time use identity protection personal identification number (IP PIN) as added security. The IRS mails IP PINs between mid-December and early January, so look for your IP PIN during this time period. 3. Contribute to retirement accounts. Making contributions to tax-advantaged retirement accounts like a traditional IRA or 401(k) is a great way to lower your tax liability, even if you don’t plan to itemize your deductions! 4. Harvest gains & losses. If you expect to have capital gains from your investments, selling stocks in a loss position to offset the gains will lower your tax liability. In fact, you can claim excess losses of up to $3,000 to decrease your ordinary income, such as wages from your job! Timing matters with investment sales and income taxes, so having a year-end strategy can help lower your tax bill. 5. Make last-minute tax moves. Here are a few ideas worth considering:

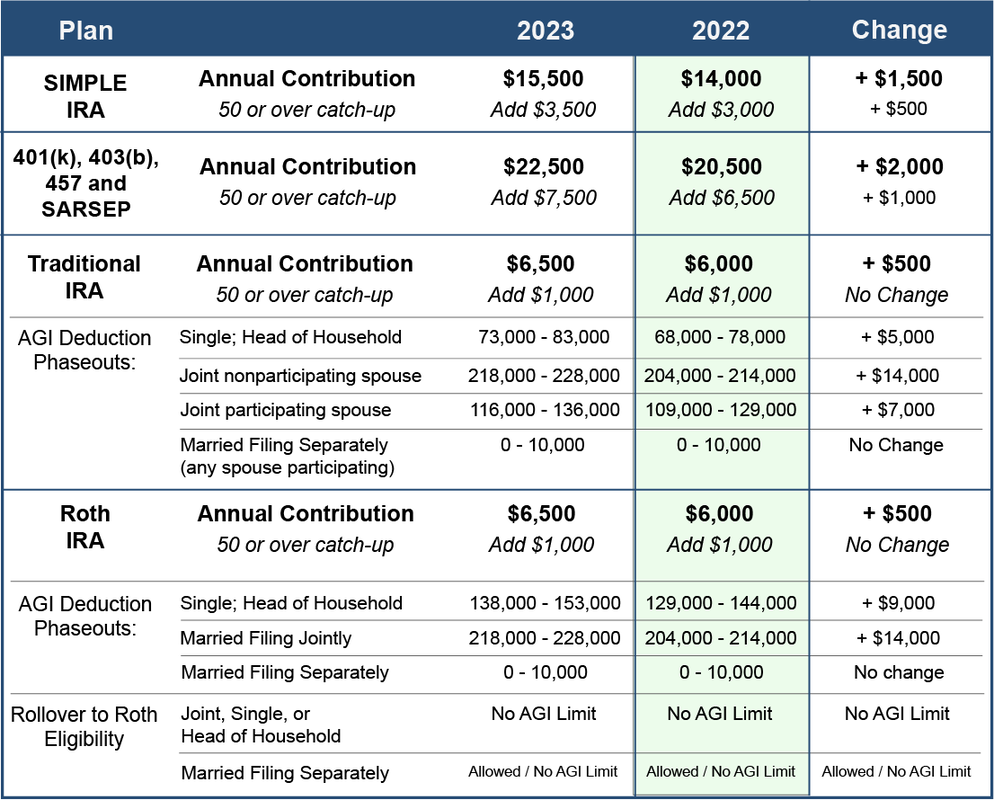

Understanding your current situation and having a plan will help maximize your year-end tax savings. "Tax Tips" are published to provide current tax information, tax-cutting suggestions, and tax reminders. If you would like more information on anything in "Tax Tips," or if you'd like to be on our mailing list to receive other tax information from time to time, please contact our office. The tax information contained in this site is of a general nature and should not be acted upon in your specific situation without further details and/or professional assistance. We are trusted CPA advisors servicing Burr Ridge, Hinsdale, Willowbrook, Darien, Naperville, and all Chicagoland area. Do you need assistance with your business and/or personal tax returns? Would you like to have a trusted source for your accounting, allowing you additional time to focus on increasing your business? Do you use QuickBooks, or plan to in the future, for your accounting? We include these in all our service packages, customized to fit your personal or business needs. We are currently accepting new clients. Your initial consultation is free, so you have nothing to lose and everything to gain. Our experienced staff is available to help you streamline your accounting, giving you more free time for yourself. Set up an appointment today by calling (630) 320-3720 or email us at [email protected]. For more free resources, such as Tax Organizers, and Record Retention Schedules, access our website www.monarchaccountinggroup.com. Mia Verc, CPA; Janice Papais, CPA The amount individuals can contribute to their 401(k) plans in 2023 will increase to $22,500 -- up from $20,500 for 2022. The income ranges for determining eligibility to make deductible contributions to traditional IRAs, contribute to Roth IRAs, and claim the Saver's Credit will also all increase for 2023.

Taxpayers can read the technical guidance regarding all of the cost‑of‑living adjustments affecting dollar limitations for pension plans and other retirement-related items for tax year 2023 in Notice 2022-55 on IRS.gov. Here are some of the changes for 2023:

"Tax Tips" are published to provide current tax information, tax-cutting suggestions, and tax reminders. If you would like more information on anything in "Tax Tips," or if you'd like to be on our mailing list to receive other tax information from time to time, please contact our office. The tax information contained in this site is of a general nature and should not be acted upon in your specific situation without further details and/or professional assistance. We are trusted CPA advisors servicing Burr Ridge, Hinsdale, Willowbrook, Darien, Naperville, and all Chicagoland area. Do you need assistance with your business and/or personal tax returns? Would you like to have a trusted source for your accounting, allowing you additional time to focus on increasing your business? Do you use QuickBooks, or plan to in the future, for your accounting? We include these in all our service packages, customized to fit your personal or business needs. We are currently accepting new clients. Your initial consultation is free, so you have nothing to lose and everything to gain. Our experienced staff is available to help you streamline your accounting, giving you more free time for yourself. Set up an appointment today by calling (630) 320-3720 or email us at [email protected]. For more free resources, such as Tax Organizers, and Record Retention Schedules, access our website www.monarchaccountinggroup.com. Mia Verc, CPA; Janice Papais, CPA As part of your planning for next year, now is the time to review funding your retirement accounts in 2023. Recent cost of living calculations means much higher contribution limits for next year. Plus the higher income phaseouts for eligibility will make many more taxpayers eligible for fully-deductible contributions. So plan now to take full advantage of this tax benefit. Here are annual contribution limits for the more popular programs: How to use

Other ideas If you have not already done so, also consider:

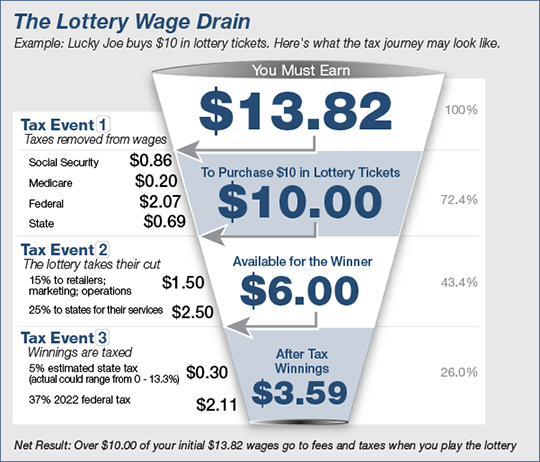

"Tax Tips" are published to provide current tax information, tax-cutting suggestions, and tax reminders. If you would like more information on anything in "Tax Tips," or if you'd like to be on our mailing list to receive other tax information from time to time, please contact our office. The tax information contained in this site is of a general nature and should not be acted upon in your specific situation without further details and/or professional assistance. We are trusted CPA advisors servicing Burr Ridge, Hinsdale, Willowbrook, Darien, Naperville, and all Chicagoland area. Do you need assistance with your business and/or personal tax returns? Would you like to have a trusted source for your accounting, allowing you additional time to focus on increasing your business? Do you use QuickBooks, or plan to in the future, for your accounting? We include these in all our service packages, customized to fit your personal or business needs. We are currently accepting new clients. Your initial consultation is free, so you have nothing to lose and everything to gain. Our experienced staff is available to help you streamline your accounting, giving you more free time for yourself. Set up an appointment today by calling (630) 320-3720 or email us at [email protected]. For more free resources, such as Tax Organizers, and Record Retention Schedules, access our website www.monarchaccountinggroup.com. Mia Verc, CPA; Janice Papais, CPA And everyone seems happy to payNow that the dust has settled on the big lottery winnings, it is worthwhile to see how the tax math works. Seen in the light of day, it is a great way for federal and state governments to triple tax this income and get even the lowest income households to pay it. So as media outlets shine a light on the lucky winner, consider what the tax looks like. The bottom line when seen from a wage stand point is that 74% or more of the income used to play the lottery does not end up in the hands of the winner. The true winner is the tax man. Just one more example of tax collection and ethics taking different roads.

"Tax Tips" are published to provide current tax information, tax-cutting suggestions, and tax reminders. If you would like more information on anything in "Tax Tips," or if you'd like to be on our mailing list to receive other tax information from time to time, please contact our office. The tax information contained in this site is of a general nature and should not be acted upon in your specific situation without further details and/or professional assistance. We are trusted CPA advisors servicing Burr Ridge, Hinsdale, Willowbrook, Darien, Naperville, and all Chicagoland area. Do you need assistance with your business and/or personal tax returns? Would you like to have a trusted source for your accounting, allowing you additional time to focus on increasing your business? Do you use QuickBooks, or plan to in the future, for your accounting? We include these in all our service packages, customized to fit your personal or business needs. We are currently accepting new clients. Your initial consultation is free, so you have nothing to lose and everything to gain. Our experienced staff is available to help you streamline your accounting, giving you more free time for yourself. Set up an appointment today by calling (630) 320-3720 or email us at [email protected]. For more free resources, such as Tax Organizers, and Record Retention Schedules, access our website www.monarchaccountinggroup.com. Mia Verc, CPA; Janice Papais, CPA If you own a business, you know that you may accelerate the expensing of qualified capital purchases. This can be done within two special provisions in the tax code:

Section 179 The annual amount of qualified assets that may be expensed (instead of depreciated) was raised to $1.08 million for 2022. This benefit can be maximized as long as the total assets purchased by your business don't exceed $2.7 million. Qualified purchases can be new or used equipment, as well as qualified software placed in service during the year. Bonus Depreciation There is also an option to chose additional first-year bonus depreciation of 100 percent of the cost of qualified property. To qualify the property must be purchased and placed in service before 2023. After that, an annual phaseout lowers the bonus deduction percentage. Property can be new or used, but it can't be in use by you before it was acquired. There are a few exclusions for electrical energy and gas or steam distribution. Not interested in claiming the bonus depreciation expense? Then you may choose to opt out of this provision for each category (class) of property you place in service. What should you do? Taking advantage of these provisions may be good for your business, but that's not always the case. Remember, if you use these special asset-expensing provisions, depreciation expense taken this year is given up in future years. How many future years depend on the recovery period of the asset, but the additional tax exposure could be up to two decades! This is especially important to consider if your company is organized as a passthrough entity, like an S Corporation, as more income could be exposed to higher marginal taxes. The short-term tax savings these two provisions provide is often too good to pass up. However, if you have some predictability in your business, it probably makes sense to forecast your projected pre-tax earnings with and without the accelerated depreciation to ensure you are making the correct long-term tax decision. "Tax Tips" are published to provide current tax information, tax-cutting suggestions, and tax reminders. If you would like more information on anything in "Tax Tips," or if you'd like to be on our mailing list to receive other tax information from time to time, please contact our office. The tax information contained in this site is of a general nature and should not be acted upon in your specific situation without further details and/or professional assistance. We are trusted CPA advisors servicing Burr Ridge, Hinsdale, Willowbrook, Darien, Naperville, and all Chicagoland area. Do you need assistance with your business and/or personal tax returns? Would you like to have a trusted source for your accounting, allowing you additional time to focus on increasing your business? Do you use QuickBooks, or plan to in the future, for your accounting? We include these in all our service packages, customized to fit your personal or business needs. We are currently accepting new clients. Your initial consultation is free, so you have nothing to lose and everything to gain. Our experienced staff is available to help you streamline your accounting, giving you more free time for yourself. Set up an appointment today by calling (630) 320-3720 or email us at [email protected]. For more free resources, such as Tax Organizers, and Record Retention Schedules, access our website www.monarchaccountinggroup.com. Mia Verc, CPA; Janice Papais, CPA |

BLOGTo better serve our clients and friends, to keep you up-to-date and informed, our blog is a resource for tax tips and overall accounting related articles. We hope you find this useful! CATEGORIES

All

ARCHIVES

September 2023

|

|

Phone: (630) 320-3720

Monarch Accounting Group Inc 145 Tower Drive, Suite 10 Burr Ridge, IL 60527-7836 Email: [email protected] |

RSS Feed

RSS Feed