|

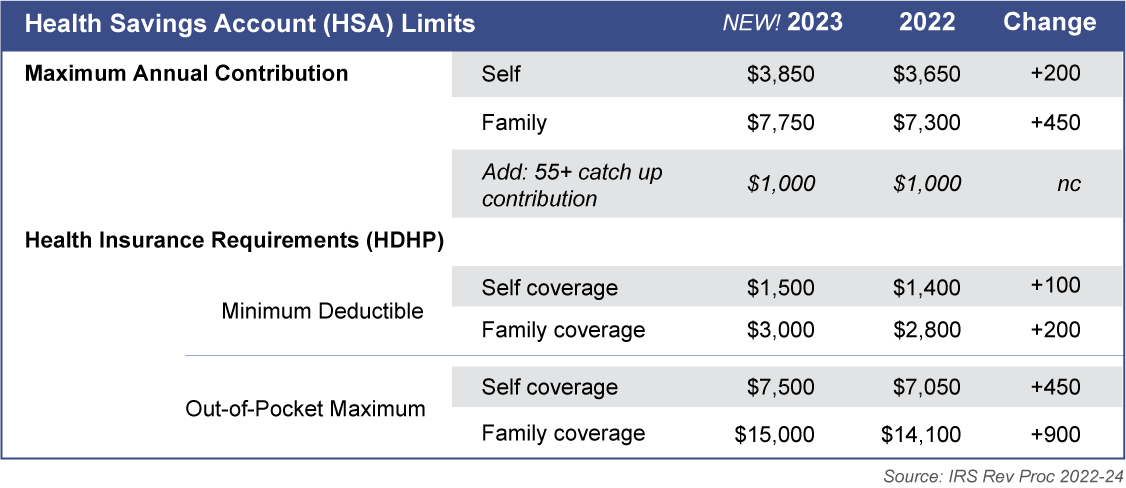

Contribution limits for the ever-popular health savings account (HSA) are set for 2023. The new limits are outlined here with current year amounts noted for comparison. So plan now for your 2023 contributions. What is an HSA? An HSA is a tax-advantaged savings account whose funds can be used to pay qualified health care costs for you, your spouse and your dependents. The account is a great way to pay for qualified health care costs with pre-tax dollars. In fact, any investment gains on your funds are also tax-free as long as they are used to pay for qualified medical, dental or vision expenses. Unused funds may be carried over from one year to the next. You must be enrolled in a high-deductible health plan (HDHP) to use an HSA. The limits Note: An HDHP plan has minimum deductible requirements that are typically higher than traditional health insurance plans. To qualify for an HSA, your health coverage must have out-of-pocket payment limits in line with the maximums noted above.

The key is to maximize funds to pay for your medical, dental, and vision care expenses with pre-tax money. By building your account now, you could have a next egg for unforeseen future expenses. "Tax Tips" are published to provide current tax information, tax-cutting suggestions, and tax reminders. If you would like more information on anything in "Tax Tips," or if you'd like to be on our mailing list to receive other tax information from time to time, please contact our office. The tax information contained in this site is of a general nature and should not be acted upon in your specific situation without further details and/or professional assistance. We are trusted CPA advisors servicing Burr Ridge, Hinsdale, Willowbrook, Darien, Naperville, and all Chicagoland area. Do you need assistance with your business and/or personal tax returns? Would you like to have a trusted source for your accounting, allowing you additional time to focus on increasing your business? Do you use QuickBooks, or plan to in the future, for your accounting? We include these in all our service packages, customized to fit your personal or business needs. We are currently accepting new clients. Your initial consultation is free, so you have nothing to lose and everything to gain. Our experienced staff is available to help you streamline your accounting, giving you more free time for yourself. Set up an appointment today by calling (630) 320-3720 or email us at [email protected]. For more free resources, such as Tax Organizers, and Record Retention Schedules, access our website www.monarchaccountinggroup.com. Mia Verc, CPA; Janice Papais, CPA

0 Comments

The Taxpayer Advocate Service is an independent organization within the Internal Revenue Service. TAS protects taxpayers’ rights by striving to ensure that all taxpayers are treated fairly and know and understand their rights under the Taxpayer Bill of Rights.

Here’s what all taxpayers should know about their rights and the role of the Taxpayer Advocate Service. What is the Taxpayer Bill of Rights? The Taxpayer Bill of Rights describes ten basic rights that all taxpayers have when dealing with the IRS. The TAS taxpayer rights webpage can help taxpayers understand what these rights mean to them and how they apply. All taxpayers should know these rights. The TAS website can help taxpayers with common tax issues and situations. These include what to do if a taxpayer made a mistake on their tax return, if they got a notice from the IRS, or they’re thinking about hiring a tax return preparer. What can the Taxpayer Advocate Service do for taxpayers? TAS can help taxpayers resolve problems that they haven’t been able to resolve with the IRS on their own. The service is free. TAS helps all taxpayers and their representatives, including individuals, businesses, and exempt organizations. If taxpayers qualify for TAS help, an advocate will be with them at every turn and do everything possible to assist throughout the process. Taxpayers may be eligible for TAS help if:

How to contact a local Taxpayer Advocate Service office TAS has offices in every state, the District of Columbia, and Puerto Rico. There are several ways taxpayers can find their local TAS office phone number.

The Taxpayer Advocate Service is the taxpayer’s voice at the IRS. For more information taxpayers should, visit the TAS website. Share this tip on social media -- #IRSTaxTip: Taxpayer Advocate Service: Dedicated to helping taxpayers. http://ow.ly/Iryf50JWL6w "Tax Tips" are published to provide current tax information, tax-cutting suggestions, and tax reminders. If you would like more information on anything in "Tax Tips," or if you'd like to be on our mailing list to receive other tax information from time to time, please contact our office. The tax information contained in this site is of a general nature and should not be acted upon in your specific situation without further details and/or professional assistance. We are trusted CPA advisors servicing Burr Ridge, Hinsdale, Willowbrook, Darien, Naperville, and all Chicagoland area. Do you need assistance with your business and/or personal tax returns? Would you like to have a trusted source for your accounting, allowing you additional time to focus on increasing your business? Do you use QuickBooks, or plan to in the future, for your accounting? We include these in all our service packages, customized to fit your personal or business needs. We are currently accepting new clients. Your initial consultation is free, so you have nothing to lose and everything to gain. Our experienced staff is available to help you streamline your accounting, giving you more free time for yourself. Set up an appointment today by calling (630) 320-3720 or email us at [email protected]. For more free resources, such as Tax Organizers, and Record Retention Schedules, access our website www.monarchaccountinggroup.com. Mia Verc, CPA; Janice Papais, CPA Each year, the IRS audits over 1 million tax returns.

With agency resources shrinking, the IRS is more selective when choosing which tax returns to audit. Knowing what the IRS is looking for can help you understand and reduce your audit risk. Here are five of the biggest reasons the IRS may choose to audit your return:

"Tax Tips" are published to provide current tax information, tax-cutting suggestions, and tax reminders. If you would like more information on anything in "Tax Tips," or if you'd like to be on our mailing list to receive other tax information from time to time, please contact our office. The tax information contained in this site is of a general nature and should not be acted upon in your specific situation without further details and/or professional assistance. We are trusted CPA advisors servicing Burr Ridge, Hinsdale, Willowbrook, Darien, Naperville, and all Chicagoland area. Do you need assistance with your business and/or personal tax returns? Would you like to have a trusted source for your accounting, allowing you additional time to focus on increasing your business? Do you use QuickBooks, or plan to in the future, for your accounting? We include these in all our service packages, customized to fit your personal or business needs. We are currently accepting new clients. Your initial consultation is free, so you have nothing to lose and everything to gain. Our experienced staff is available to help you streamline your accounting, giving you more free time for yourself. Set up an appointment today by calling (630) 320-3720 or email us at [email protected]. For more free resources, such as Tax Organizers, and Record Retention Schedules, access our website www.monarchaccountinggroup.com. Mia Verc, CPA; Janice Papais, CPA One of the basics when considering how to fund your retirement is to be as tax efficient with your income as possible. In 2022, income tax rates range from 0 to 37 percent, plus a potential 3.8 percent net investment tax. Understanding how these progressive tax rates apply to ordinary income creates a tremendous retirement planning opportunity.

The basic concept Many retirees can control their taxable income each year by the amount they work and how much they withdraw from retirement savings accounts like IRAs and 401(k)s. Because you can control the amount of your taxable income by the amount you withdraw from your retirement savings, you can ensure your income is as tax efficient as possible. Example: A single taxpayer pays 24% on taxable income from approximately $89,000 to $170,000. The next taxable dollar you earn above $170,000 is then taxed at 32%. So if you are making $100,000, you can choose to be tax efficient withdrawing up to $70,000 from your traditional IRA before you jump to the next tax bracket. Note: Taxable income typically includes wages, interest, non-qualified dividends, short-term capital gains (assets owned for one year or less), taxable Social Security benefits and withdrawals from most 401(k), 403(b), and non-Roth IRAs. Other factors add complexity Planning for tax-efficient retirement, however, is never simple. There are other things to consider:

What to do? Making tax efficiency an integral part of your retirement plan can be complicated. But the rewards are tremendous for those willing to start early, dedicating the time to planning, and asking for assistance. "Tax Tips" are published to provide current tax information, tax-cutting suggestions, and tax reminders. If you would like more information on anything in "Tax Tips," or if you'd like to be on our mailing list to receive other tax information from time to time, please contact our office. The tax information contained in this site is of a general nature and should not be acted upon in your specific situation without further details and/or professional assistance. We are trusted CPA advisors servicing Burr Ridge, Hinsdale, Willowbrook, Darien, Naperville, and all Chicagoland area. Do you need assistance with your business and/or personal tax returns? Would you like to have a trusted source for your accounting, allowing you additional time to focus on increasing your business? Do you use QuickBooks, or plan to in the future, for your accounting? We include these in all our service packages, customized to fit your personal or business needs. We are currently accepting new clients. Your initial consultation is free, so you have nothing to lose and everything to gain. Our experienced staff is available to help you streamline your accounting, giving you more free time for yourself. Set up an appointment today by calling (630) 320-3720 or email us at [email protected]. For more free resources, such as Tax Organizers, and Record Retention Schedules, access our website www.monarchaccountinggroup.com. Mia Verc, CPA; Janice Papais, CPA |

BLOGTo better serve our clients and friends, to keep you up-to-date and informed, our blog is a resource for tax tips and overall accounting related articles. We hope you find this useful! CATEGORIES

All

ARCHIVES

September 2023

|

|

Phone: (630) 320-3720

Monarch Accounting Group Inc 145 Tower Drive, Suite 10 Burr Ridge, IL 60527-7836 Email: [email protected] |

RSS Feed

RSS Feed