Treasury and IRS begin delivering second round of Economic Impact Payments to millions of Americans12/30/2020 WASHINGTON – Today, the Internal Revenue Service and the Treasury Department will begin delivering a second round of Economic Impact Payments as part of the Coronavirus Response and Relief Supplemental Appropriations Act of 2021 to millions of Americans who received the first round of payments earlier this year.

The initial direct deposit payments may begin arriving as early as tonight for some and will continue into next week. Paper checks will begin to be mailed tomorrow, Wednesday, Dec. 30. The IRS emphasizes that there is no action required by eligible individuals to receive this second payment. Some Americans may see the direct deposit payments as pending or as provisional payments in their accounts before the official payment date of Jan. 4, 2021. The IRS reminds taxpayers that the payments are automatic, and they should not contact their financial institutions or the IRS with payment timing questions. As with the first round of payments under the CARES Act, most recipients will receive these payments by direct deposit. For Social Security and other beneficiaries who received the first round of payments via Direct Express, they will receive this second payment the same way. Anyone who received the first round of payments earlier this year but doesn’t receive a payment via direct deposit will generally receive a check or, in some instances, a debit card. For those in this category, the payments will conclude in January. If additional legislation is enacted to provide for an additional amount, the Economic Impact Payments that have been issued will be topped up as quickly as possible. Eligible individuals who did not receive an Economic Impact Payment this year – either the first or the second payment – will be able to claim it when they file their 2020 taxes in 2021. The IRS urges taxpayers who didn’t receive a payment this year to review the eligibility criteria when they file their 2020 taxes; many people, including recent college graduates, may be eligible to claim it. People will see the Economic Impact Payments (EIP) referred to as the Recovery Rebate Credit (RRC) on Form 1040 or Form 1040-SR since the EIPs are an advance payment of the RRC. “Throughout this challenging year, the IRS has worked around the clock to provide Economic Impact Payments and critical taxpayer services to the American people,” said IRS Commissioner Chuck Rettig. “We are working swiftly to distribute this second round of payments as quickly as possible. This work continues throughout the holidays and into the new year as we prepare for the upcoming filing season. We urge everyone to visit IRS.gov in the coming days for the latest information on these payments and for important information and assistance with filing their 2021 taxes.” Authorized by the newly enacted COVID-relief legislation, the second round of payments, or “EIP 2,” is generally $600 for singles and $1,200 for married couples filing a joint return. In addition, those with qualifying children will also receive $600 for each qualifying child. Dependents who are 17 and older are not eligible for the child payment. Payments are automatic for eligible taxpayers Payments are automatic for eligible taxpayers who filed a 2019 tax return, those who receive Social Security retirement, survivor or disability benefits (SSDI), Railroad Retirement benefits as well as Supplemental Security Income (SSI) and Veterans Affairs beneficiaries who didn’t file a tax return. Payments are also automatic for anyone who successfully registered for the first payment online at IRS.gov using the agency’s Non-Filers tool by Nov. 21, 2020 or who submitted a simplified tax return that has been processed by the IRS. Who is eligible for the second Economic Impact Payment? Generally, U.S. citizens and resident aliens who are not eligible to be claimed as a dependent on someone else’s income tax return are eligible for this second payment. Eligible individuals will automatically receive an Economic Impact Payment of up to $600 for individuals or $1,200 for married couples and up to $600 for each qualifying child. Generally, if you have adjusted gross income for 2019 up to $75,000 for individuals and up to $150,000 for married couples filing joint returns and surviving spouses, you will receive the full amount of the second payment. For filers with income above those amounts, the payment amount is reduced. How do I find out if the IRS is sending me a payment? People can check the status of both their first and second payments by using the Get My Payment tool, available in English and Spanish only on IRS.gov. The tool is being updated with new information, and the IRS anticipates the tool will be available again in a few days for taxpayers. How will the IRS know where to send my payment? What if I changed bank accounts? The IRS will use the data already in our systems to send the new payments. Taxpayers with direct deposit information on file will receive the payment that way. For those without current direct deposit information on file, they will receive the payment as a check or debit card in the mail. For those eligible but who don’t receive the payment for any reason, it can be claimed by filing a 2020 tax return in 2021. Remember, the Economic Impact Payments are an advance payment of what will be called the Recovery Rebate Credit on the 2020 Form 1040 or Form 1040-SR. Will people receive a paper check or a debit card? For those who don’t receive a direct deposit by early January, they should watch their mail for either a paper check or a debit card. To speed delivery of the payments to reach as many people as soon as possible, the Bureau of the Fiscal Service, part of the Treasury Department, will be sending a limited number of payments out by debit card. Please note that the form of payment for the second mailed EIP may be different than for the first mailed EIP. Some people who received a paper check last time might receive a debit card this time, and some people who received a debit card last time may receive a paper check. IRS and Treasury urge eligible people who don’t receive a direct deposit to watch their mail carefully during this period for a check or an Economic Impact Payment card, which is sponsored by the Treasury Department’s Bureau of the Fiscal Service and is issued by Treasury’s financial agent, MetaBank®, N.A. The Economic Impact Payment Card will be sent in a white envelope that prominently displays the U.S. Department of the Treasury seal. It has the Visa name on the front of the Card and the issuing bank, MetaBank®, N.A. on the back of the card. Information included with the card will explain that this is your Economic Impact Payment. More information about these cards is available at EIPcard.com. Are more people eligible now for a payment than before? Under the earlier CARES Act, joint returns of couples where only one member of the couple had a Social Security number were generally ineligible for a payment – unless they were a member of the military. But this month’s new law changes and expands that provision, and more people are now eligible. In this situation, these families will now be eligible to receive payments for the taxpayers and qualifying children of the family who have work-eligible SSNs. People in this group who don’t receive an Economic Impact Payment can claim this when they file their 2020 taxes under the Recovery Rebate Credit. Is any action needed by Social Security beneficiaries, railroad retirees and those receiving veterans’ benefits who are not typically required to file a tax return? Most Social Security retirement and disability beneficiaries, railroad retirees and those receiving veterans’ benefits do not need take any action to receive a payment. Earlier this year, the IRS worked directly with the relevant federal agencies to obtain the information needed to send out the new payments the same way benefits for this group are normally paid. For eligible people in this group who didn’t receive a payment for any reason, they can file a 2020 tax return. I didn’t file a tax return and didn’t register with the IRS.gov non-filers tool. Am I eligible for a payment? Yes, if you meet the eligibility requirement. While you won’t receive an automatic payment now, you can still claim the equivalent Recovery Rebate Credit when you file your 2020 federal income tax return. Will I receive anything for my tax records showing I received a second Economic Impact Payment? Yes. People will receive an IRS notice, or letter, after they receive a payment telling them the amount of their payment. They should keep this for their tax records. Where can I get more information? For more information about Economic Impact Payments and the 2020 Recovery Rebate, key information will be posted on IRS.gov/eip. Later this week, you may check the status of your payment at IRS.gov/GetMyPayment. For other COVID-19-related tax relief, visit IRS.gov/Coronavirus. "Tax Tips" are published to provide current tax information, tax-cutting suggestions, and tax reminders. If you would like more information on anything in "Tax Tips," or if you'd like to be on our mailing list to receive other tax information from time to time, please contact our office. The tax information contained in this site is of a general nature and should not be acted upon in your specific situation without further details and/or professional assistance. We are trusted CPA advisors servicing Burr Ridge, Hinsdale, Willowbrook, Darien, Naperville, and all Chicagoland area. Do you need assistance with your business and/or personal tax returns? Would you like to have a trusted source for your accounting, allowing you additional time to focus on increasing your business? Do you use QuickBooks, or plan to in the future, for your accounting? We include these in all our service packages, customized to fit your personal or business needs. We are currently accepting new clients. Your initial consultation is free, so you have nothing to lose and everything to gain. Our experienced staff is available to help you streamline your accounting, giving you more free time for yourself. Set up an appointment today by calling (630) 320-3720 or email us at [email protected]. For more free resources, such as Tax Rates, Tax Organizers, and Record Retention Schedules, access our website www.monarchaccountinggroup.com. Monarch Accounting Group, Inc 145 Tower Drive, Suite 4 Burr Ridge, IL 60527 Phone (630) 320-3720

0 Comments

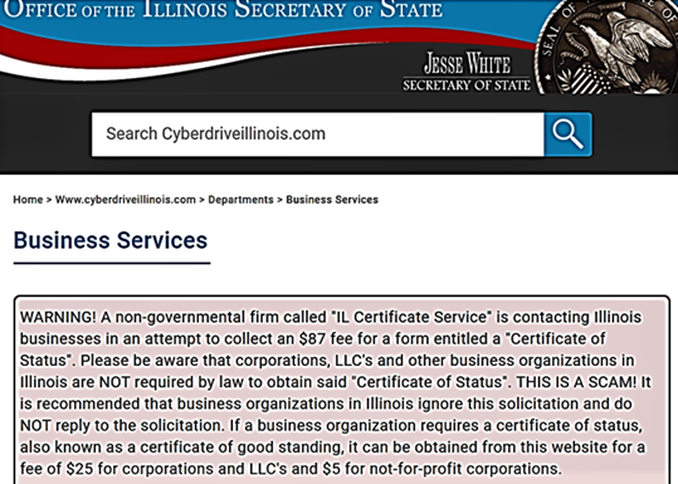

In the process of filing IL Annual Reports, we noticed that IL was warning of a scam that is going around. We thought we would share to prevent any of our clients from being misled or taken advantage of.

Journal of Accountancy article COVID-19 relief bill addresses key PPP issues talks about second round of PPP funds and tax deductibility for PPP expenses.

American Action Forum article Major Tax Policy Changes in the Consolidated Appropriations Act talks about fiscal relief package, appropriations act, and tax extenders package. We highly encourage taxpayers to read those two articles to understand how Consolidated Appropriations Act 2021 (CAA) will impact you. If you have any questions, don't hesitate to contact us. "Tax Tips" are published to provide current tax information, tax-cutting suggestions, and tax reminders. If you would like more information on anything in "Tax Tips," or if you'd like to be on our mailing list to receive other tax information from time to time, please contact our office. The tax information contained in this site is of a general nature and should not be acted upon in your specific situation without further details and/or professional assistance. We are trusted CPA advisors servicing Burr Ridge, Hinsdale, Willowbrook, Darien, Naperville, and all Chicagoland area. Do you need assistance with your business and/or personal tax returns? Would you like to have a trusted source for your accounting, allowing you additional time to focus on increasing your business? Do you use QuickBooks, or plan to in the future, for your accounting? We include these in all our service packages, customized to fit your personal or business needs. We are currently accepting new clients. Your initial consultation is free, so you have nothing to lose and everything to gain. Our experienced staff is available to help you streamline your accounting, giving you more free time for yourself. Set up an appointment today by calling (630) 320-3720 or email us at [email protected]. For more free resources, such as Tax Rates, Tax Organizers, and Record Retention Schedules, access our website www.monarchaccountinggroup.com. Monarch Accounting Group, Inc 145 Tower Drive, Suite 4 Burr Ridge, IL 60527 Phone (630) 320-3720 Each year the IRS publishes the top dozen tax scams it encounters over the prior year. One of them that makes an all too common appearance on their list is the phishing scam. Here is what you need to know.

Phishing requires bait Phishing is the act of creating a fake e-mail or website that looks like the real thing. This "bait" is then used to bring you into the scam by asking for private information. This includes your name, address, or phone number. It could also include potentially dangerous ID theft information like your Social Security number, a credit card number or banking information. The bait is often very real looking - just like correspondence from the IRS or the IRS web site. How to avoid the lure How do you know the phishing is fake? Here are some tips.

What do phishers do? When the phishers have your information, they can file false tax returns requesting refunds, steal bank information, set up fake credit cards, establish false IDs, plus much more. Remember, if it smells like a phish, it probably is. "Tax Tips" are published to provide current tax information, tax-cutting suggestions, and tax reminders. If you would like more information on anything in "Tax Tips," or if you'd like to be on our mailing list to receive other tax information from time to time, please contact our office. The tax information contained in this site is of a general nature and should not be acted upon in your specific situation without further details and/or professional assistance. We are trusted CPA advisors servicing Burr Ridge, Hinsdale, Willowbrook, Darien, Naperville, and all Chicagoland area. Do you need assistance with your business and/or personal tax returns? Would you like to have a trusted source for your accounting, allowing you additional time to focus on increasing your business? Do you use QuickBooks, or plan to in the future, for your accounting? We include these in all our service packages, customized to fit your personal or business needs. We are currently accepting new clients. Your initial consultation is free, so you have nothing to lose and everything to gain. Our experienced staff is available to help you streamline your accounting, giving you more free time for yourself. Set up an appointment today by calling (630) 320-3720 or email us at [email protected]. For more free resources, such as Tax Rates, Tax Organizers, and Record Retention Schedules, access our website www.monarchaccountinggroup.com. Monarch Accounting Group, Inc 145 Tower Drive, Suite 4 Burr Ridge, IL 60527 Phone (630) 320-3720 Most taxpayers can deduct up to $300 in charitable contributions without itemizing deductions12/15/2020 Following tax law changes, cash donations of up to $300 made this year by December 31, 2020 are now deductible without having to itemize when people file their taxes in 2021.

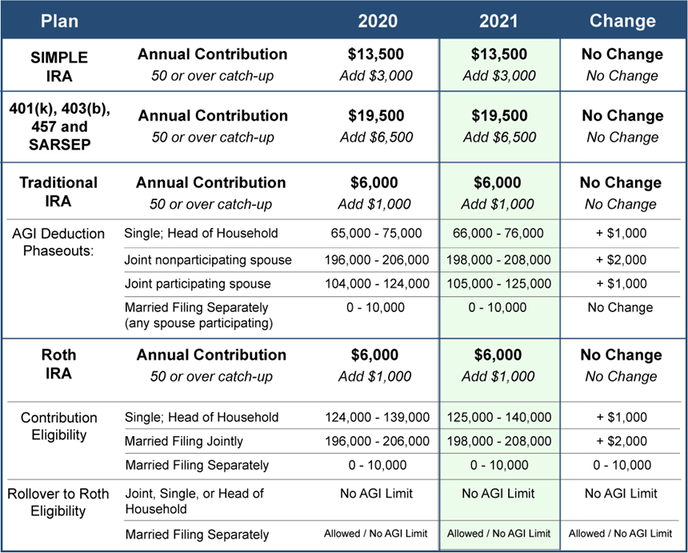

The Coronavirus Aid, Relief and Economic Security Act includes several temporary tax law changes to help charities. This includes the special $300 deduction designed especially for people who choose to take the standard deduction, rather than itemizing their deductions. This change allows individual taxpayers to claim a deduction of up to $300 for cash donations made to charity during 2020. This deduction lowers both adjusted gross income and taxable income – translating into tax savings for those making donations to qualifying tax-exempt organizations. Before making a donation, taxpayers should check the Tax Exempt Organization Search tool on IRS.gov to make sure the organization is eligible for tax deductible donations. Cash donations include those made by check, credit card or debit card. They don't include securities, household items or other property. Though cash contributions to most charitable organizations qualify, some don’t. People should review Publication 526, Charitable Contributions for details. Cash contributions made to supporting organizations are not tax deductible. The CARES Act includes other temporary allowances designed to help charities. These include higher charitable contribution limits for corporations, individuals who itemize their deductions and businesses that give food inventory to food banks and other eligible charities. For more information, visit the Coronavirus Tax Relief page of IRS.gov. By law, recordkeeping rules apply to any taxpayer claiming a charitable contribution deduction. Usually, this includes getting a receipt or acknowledgement letter from the charity before filing a return and retaining a cancelled check or credit card receipt. More information: A Closer Look: Special tax deductions available this year "Tax Tips" are published to provide current tax information, tax-cutting suggestions, and tax reminders. If you would like more information on anything in "Tax Tips," or if you'd like to be on our mailing list to receive other tax information from time to time, please contact our office. The tax information contained in this site is of a general nature and should not be acted upon in your specific situation without further details and/or professional assistance. We are trusted CPA advisors servicing Burr Ridge, Hinsdale, Willowbrook, Darien, Naperville, and all Chicagoland area. Do you need assistance with your business and/or personal tax returns? Would you like to have a trusted source for your accounting, allowing you additional time to focus on increasing your business? Do you use QuickBooks, or plan to in the future, for your accounting? We include these in all our service packages, customized to fit your personal or business needs. We are currently accepting new clients. Your initial consultation is free, so you have nothing to lose and everything to gain. Our experienced staff is available to help you streamline your accounting, giving you more free time for yourself. Set up an appointment today by calling (630) 320-3720 or email us at [email protected]. For more free resources, such as Tax Rates, Tax Organizers, and Record Retention Schedules, access our website www.monarchaccountinggroup.com. Monarch Accounting Group, Inc 145 Tower Drive, Suite 4 Burr Ridge, IL 60527 Phone (630) 320-372 As part of your planning for next year, now is the time to review funding your retirement accounts. By establishing your contribution amounts at the beginning of each year, the financial impact of saving for your future should be more manageable. Here are annual contribution limits for the more popular programs: How to use

Other ideas If you have not already done so, also consider:

"Tax Tips" are published to provide current tax information, tax-cutting suggestions, and tax reminders. If you would like more information on anything in "Tax Tips," or if you'd like to be on our mailing list to receive other tax information from time to time, please contact our office. The tax information contained in this site is of a general nature and should not be acted upon in your specific situation without further details and/or professional assistance. We are trusted CPA advisors servicing Burr Ridge, Hinsdale, Willowbrook, Darien, Naperville, and all Chicagoland area. Do you need assistance with your business and/or personal tax returns? Would you like to have a trusted source for your accounting, allowing you additional time to focus on increasing your business? Do you use QuickBooks, or plan to in the future, for your accounting? We include these in all our service packages, customized to fit your personal or business needs. We are currently accepting new clients. Your initial consultation is free, so you have nothing to lose and everything to gain. Our experienced staff is available to help you streamline your accounting, giving you more free time for yourself. Set up an appointment today by calling (630) 320-3720 or email us at [email protected]. For more free resources, such as Tax Rates, Tax Organizers, and Record Retention Schedules, access our website www.monarchaccountinggroup.com. Monarch Accounting Group, Inc 145 Tower Drive, Suite 4 Burr Ridge, IL 60527 Phone (630) 320-3720 At the end of each year there are a number of things to consider that may have a positive impact on your tax obligation. Here is a list of fifteen ideas that may be worth a quick review.

1. Make last minute charitable donations. 2. Review and maximize use of the $15,000 annual gift giving limit. 3. Review your investment portfolio for capital gain and loss planning. 4. Use your annual $3,000 net capital loss limit to lower ordinary income if appropriate. 5. Maximize the kiddie tax threshold rules ($2,200 of unearned income taxed at your child’s lower tax rate). 6. Consider fully funding retirement account annual contributions. 7. Identify any potential tax forms required for household employees. 8. Consider donating appreciated stock owned one year or longer. 9. Review retirement accounts. While required minimum distributions (RMD) are waived this year, you may still wish to remove funds to be tax efficient. 10. Review medical and dependent care funding accounts to ensure you do not lose contributions that do not rollover into the new year. 11. Consider retirement plan rollover options into Roth IRAs. 12. Estimate your tax liability and make any final estimated tax payments. This is especially important to small business owners that must pay taxes on any potential loan forgiveness. 13. Create a list of expected 1099 and other tax forms you will be receiving. Remember to note that you may be receiving 1099-NEC forms that are new this year! 14. Review your W-2 withholdings and file any changes with your employer for the upcoming year. 15. Begin organizing your tax records. Should you have any questions on these ideas, ask for help prior to taking action. In many cases, the requirements and documentation needed are important to ensure you receive the full tax savings benefit. "Tax Tips" are published to provide current tax information, tax-cutting suggestions, and tax reminders. If you would like more information on anything in "Tax Tips," or if you'd like to be on our mailing list to receive other tax information from time to time, please contact our office. The tax information contained in this site is of a general nature and should not be acted upon in your specific situation without further details and/or professional assistance. We are trusted CPA advisors servicing Burr Ridge, Hinsdale, Willowbrook, Darien, Naperville, and all Chicagoland area. Do you need assistance with your business and/or personal tax returns? Would you like to have a trusted source for your accounting, allowing you additional time to focus on increasing your business? Do you use QuickBooks, or plan to in the future, for your accounting? We include these in all our service packages, customized to fit your personal or business needs. We are currently accepting new clients. Your initial consultation is free, so you have nothing to lose and everything to gain. Our experienced staff is available to help you streamline your accounting, giving you more free time for yourself. Set up an appointment today by calling (630) 320-3720 or email us at [email protected]. For more free resources, such as Tax Rates, Tax Organizers, and Record Retention Schedules, access our website www.monarchaccountinggroup.com. Monarch Accounting Group, Inc 145 Tower Drive, Suite 4 Burr Ridge, IL 60527 Phone (630) 320-3720 There are things taxpayers can do before the end of the year to help them get ready for the 2021 tax filing season. Below are a few of them.

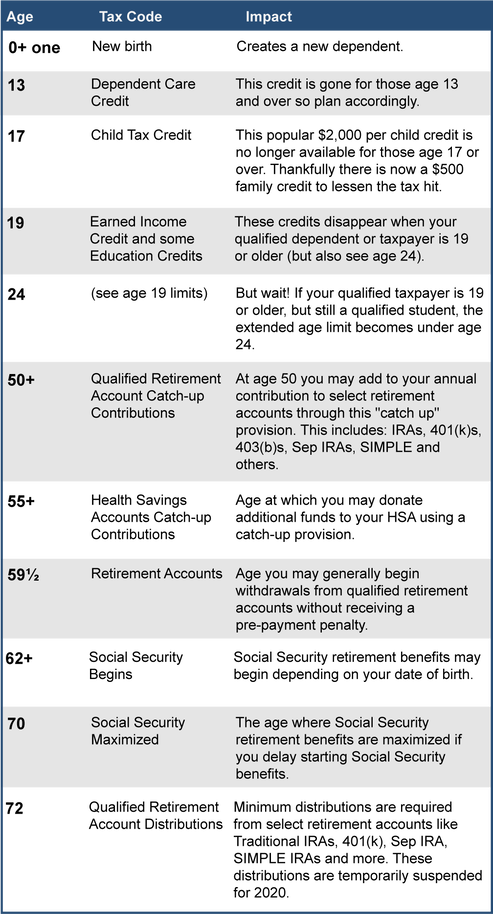

Donate to charity There is still time to make a 2020 donation. Taxpayers who don't itemize deductions may take a charitable deduction of up to $300 for cash contributions made in 2020 to qualifying charities. Cash donations include those made by check, credit card or debit card. Before making a donation, people can check the Tax Exempt Organization Search tool on IRS.gov to make sure the organization is eligible for tax-deductible donations. The Coronavirus Aid, Relief, and Economic Security Act changed this law. The CARES Act also temporarily suspends limits on charitable contributions and temporarily increases limits on contributions of food inventory. Report any name or address change Taxpayers who moved should notify the IRS of their new address. They should also notify the Social Security Administration of any name change. Renew expiring ITINs Certain Individual Taxpayer Identification Numbers expire at the end of this year. Taxpayers can visit the ITIN page on IRS.gov for more information on which numbers need renewal. Connect with the IRS Taxpayers can use social media to get the latest tax and filing tips from the IRS. The IRS shares information on things like tax changes, scam alerts, initiatives, tax products and taxpayer services. These social media tools are available in different languages, including English, Spanish and American Sign Language. Find information about retirement plans IRS.gov has end-of-year find tax information about retirement plans. This includes resources for individuals about retirement planning, contributions and withdrawals. The CARES Act retirement plan relief waived required minimum distributions during 2020 for IRA or retirement plan accounts. Also, eligible individuals can take a coronavirus-related distribution of up to $100,000 by December 30, 2020 and repay it over three years or pay the tax due over three years. Contribute salary deferral Taxpayers can make a salary deferral to a retirement plan. This helps maximize the tax credit available for eligible contributions. Taxpayers should make sure their total salary deferral contributions do not exceed the $19,500 limit for 2020. Think about tax refunds Taxpayers should be careful not to expect getting a refund by a certain date. This is especially true for those who plan to use their refund to make major purchases or pay bills. Just as each tax return is unique to the individual, so is each taxpayer's refund. Taxpayers can take steps now to get ready to file their federal tax return in 2021. More Information: About Schedule A, Form 1040, Itemized Deductions Tax Topic No. 500, Itemized Deductions Charitable Contribution Deductions Interactive Tax Assistant "Tax Tips" are published to provide current tax information, tax-cutting suggestions, and tax reminders. If you would like more information on anything in "Tax Tips," or if you'd like to be on our mailing list to receive other tax information from time to time, please contact our office. The tax information contained in this site is of a general nature and should not be acted upon in your specific situation without further details and/or professional assistance. We are trusted CPA advisors servicing Burr Ridge, Hinsdale, Willowbrook, Darien, Naperville, and all Chicagoland area. Do you need assistance with your business and/or personal tax returns? Would you like to have a trusted source for your accounting, allowing you additional time to focus on increasing your business? Do you use QuickBooks, or plan to in the future, for your accounting? We include these in all our service packages, customized to fit your personal or business needs. We are currently accepting new clients. Your initial consultation is free, so you have nothing to lose and everything to gain. Our experienced staff is available to help you streamline your accounting, giving you more free time for yourself. Set up an appointment today by calling (630) 320-3720 or email us at [email protected]. For more free resources, such as Tax Rates, Tax Organizers, and Record Retention Schedules, access our website www.monarchaccountinggroup.com. Monarch Accounting Group, Inc 145 Tower Drive, Suite 4 Burr Ridge, IL 60527 Phone (630) 320-3720 One of the elements that make our Federal Tax Code so hard to follow is that different laws apply to you based on you or your dependents’ age. To help you navigate through some of this maze here is a chart that outlines key ages and how it applies to your tax obligation. Please note: These age triggers outline some of the major tax events that relate to your age. In most cases the impacted year is the year you turn the age on this chart. Example: If your qualified dependent turns 17 any time during the year, they no longer qualify for the Child Tax Credit. This chart is not meant to be all-inclusive and there are exceptions to some of these age qualifications. Use this information to know when to ask for help. Action step. When you or anyone in your family approaches any of the ages in this chart it is a sure sign you need to spend some time understanding the tax implications of the age event. Call if this impacts you! "Tax Tips" are published to provide current tax information, tax-cutting suggestions, and tax reminders. If you would like more information on anything in "Tax Tips," or if you'd like to be on our mailing list to receive other tax information from time to time, please contact our office. The tax information contained in this site is of a general nature and should not be acted upon in your specific situation without further details and/or professional assistance. We are trusted CPA advisors servicing Burr Ridge, Hinsdale, Willowbrook, Darien, Naperville, and all Chicagoland area. Do you need assistance with your business and/or personal tax returns? Would you like to have a trusted source for your accounting, allowing you additional time to focus on increasing your business? Do you use QuickBooks, or plan to in the future, for your accounting? We include these in all our service packages, customized to fit your personal or business needs. We are currently accepting new clients. Your initial consultation is free, so you have nothing to lose and everything to gain. Our experienced staff is available to help you streamline your accounting, giving you more free time for yourself. Set up an appointment today by calling (630) 320-3720 or email us at [email protected]. For more free resources, such as Tax Rates, Tax Organizers, and Record Retention Schedules, access our website www.monarchaccountinggroup.com. Monarch Accounting Group, Inc 145 Tower Drive, Suite 4 Burr Ridge, IL 60527 Phone (630) 320-3720 |

BLOGTo better serve our clients and friends, to keep you up-to-date and informed, our blog is a resource for tax tips and overall accounting related articles. We hope you find this useful! CATEGORIES

All

ARCHIVES

September 2023

|

|

Phone: (630) 320-3720

Monarch Accounting Group Inc 145 Tower Drive, Suite 10 Burr Ridge, IL 60527-7836 Email: [email protected] |

RSS Feed

RSS Feed