|

Newly passed tax law could benefit many

Deep inside legislation passed in late 2019, is a provision that broadens the acceptable use of 529 college savings plan funds. Background 529 savings plans are available to set aside after-tax funds to pay for college and K through 12 education expenses. As long as the funds are used to pay for qualified expenses, any earnings or interest in the savings plan are tax-free. Any unused earnings on funds are subject to a penalty and income tax. The new rule To help students financially after graduation, leftover money in a 529 plan may now be used to pay off student loans. There is a $10,000 lifetime limit for the 529 plan's beneficiary and each of their siblings. For example, parents who have 4 kids can take a $10,000 distribution from the 529 plan to pay student loans for each of their children, for a total of $40,000. Ideas to use this new rule

Given the recent changes in 529 college savings plans, it makes a lot of sense to explore your options and either consider setting up an account or developing a plan for best uses of the funds in your accounts. "Tax Tips" are published to provide current tax information, tax-cutting suggestions, and tax reminders. If you would like more information on anything in "Tax Tips," or if you'd like to be on our mailing list to receive other tax information from time to time, please contact our office. The tax information contained in this site is of a general nature and should not be acted upon in your specific situation without further details and/or professional assistance. We are trusted CPA advisors servicing Burr Ridge, Hinsdale, Willowbrook, Darien, Naperville, and all Chicagoland area. Do you need assistance with your business and/or personal tax returns? Would you like to have a trusted source for your accounting, allowing you additional time to focus on increasing your business? Do you use QuickBooks, or plan to in the future, for your accounting? We include these in all our service packages, customized to fit your personal or business needs. We are currently accepting new clients. Your initial consultation is free, so you have nothing to lose and everything to gain. Our experienced staff is available to help you streamline your accounting, giving you more free time for yourself. Set up an appointment today by calling (630) 320-3720 or email us at [email protected]. For more free resources, such as Tax Rates, Tax Organizers, and Record Retention Schedules, access our website www.monarchaccountinggroup.com. Monarch Accounting Group, Inc 145 Tower Drive, Suite 4 Burr Ridge, IL 60527 Phone (630) 320-3720

0 Comments

Active duty military personnel have multiple options for free federal tax preparation. IRS Free File allows taxpayers to prepare and file their federal individual income tax return for free using brand name tax-preparation-and-filing software. While Free File is for individuals or families whose adjusted gross income was $69,000 or less last year, there’s a special offer for active duty military and their spouses. Members of military and their families who meet the income limitation may choose from any of nine companies without regard to additional eligibility requirements. Active duty military stationed in combat zones also have more time to file their tax returns. However, those with spouses and families may opt to file as soon as they are able to claim various tax benefits for which they may be eligible. If only one spouse is present to file a joint return, they must have proper authorization to file a joint tax return on behalf of their spouse. With Free File, you can use any digital device, personal computer, tablet or smart phone. Here’s how it works:

More information: "Tax Tips" are published to provide current tax information, tax-cutting suggestions, and tax reminders. If you would like more information on anything in "Tax Tips," or if you'd like to be on our mailing list to receive other tax information from time to time, please contact our office. The tax information contained in this site is of a general nature and should not be acted upon in your specific situation without further details and/or professional assistance. We are trusted CPA advisors servicing Burr Ridge, Hinsdale, Willowbrook, Darien, Naperville, and all Chicagoland area. Do you need assistance with your business and/or personal tax returns? Would you like to have a trusted source for your accounting, allowing you additional time to focus on increasing your business? Do you use QuickBooks, or plan to in the future, for your accounting? We include these in all our service packages, customized to fit your personal or business needs. We are currently accepting new clients. Your initial consultation is free, so you have nothing to lose and everything to gain. Our experienced staff is available to help you streamline your accounting, giving you more free time for yourself. Set up an appointment today by calling (630) 320-3720 or email us at [email protected]. For more free resources, such as Tax Rates, Tax Organizers, and Record Retention Schedules, access our website www.monarchaccountinggroup.com. Monarch Accounting Group, Inc 145 Tower Drive, Suite 4 Burr Ridge, IL 60527 Phone (630) 320-3720  It is late January and you realize the 1099-MISC you receive is in error. In fact, it overstates your income by $2,000. What should you do? Gather your facts. Put yourself in the shoes of the vendor, bank or investment company representative. Gather evidence they will need to support your claim to correct the tax form. This includes receipts, e-mails, and statements. Have your account number handy as well. Contact the vendor. Contact the vendor as soon as you discover the error and ask them to reissue the statement if they have not sent in their information to the IRS. If they have already sent their forms to the IRS, you will need to ask for a corrected form. Start with a phone call and then put your evidence in writing and send it to them via certified mail. Give the vendor a reasonable, yet concrete time frame to correct the error. You do not want to wonder when a correction is coming, so keep control of the timing for correction if at all possible. Written confirmation. If the vendor agrees with your change, ask for a letter from them that outlines the correction. File this letter with your tax return to help you defend against a potential audit. Tell the IRS. After a reasonable attempt to correct the error with no progress, contact the IRS to inform them of the failure to correct your information. File an extension? If you believe a correction is on the way, you may wish to file a tax extension. Remember, you will still need to pay any tax owed by the original due date. If you do not have assurance of a correction, file your tax return with correct information and provide documentation that outlines the reporting error. "Tax Tips" are published to provide current tax information, tax-cutting suggestions, and tax reminders. If you would like more information on anything in "Tax Tips," or if you'd like to be on our mailing list to receive other tax information from time to time, please contact our office. The tax information contained in this site is of a general nature and should not be acted upon in your specific situation without further details and/or professional assistance. We are trusted CPA advisors servicing Burr Ridge, Hinsdale, Willowbrook, Darien, Naperville, and all Chicagoland area. Do you need assistance with your business and/or personal tax returns? Would you like to have a trusted source for your accounting, allowing you additional time to focus on increasing your business? Do you use QuickBooks, or plan to in the future, for your accounting? We include these in all our service packages, customized to fit your personal or business needs. We are currently accepting new clients. Your initial consultation is free, so you have nothing to lose and everything to gain. Our experienced staff is available to help you streamline your accounting, giving you more free time for yourself. Set up an appointment today by calling (630) 320-3720 or email us at [email protected]. For more free resources, such as Tax Rates, Tax Organizers, and Record Retention Schedules, access our website www.monarchaccountinggroup.com. Monarch Accounting Group, Inc 145 Tower Drive, Suite 4 Burr Ridge, IL 60527 Phone (630) 320-3720 WASHINGTON – Most taxpayers can do both their federal and state tax returns for free online through Free File offered either by the IRS or by states that have a similar public-private partnership.

For 2020, taxpayers whose prior-year adjusted gross income was $69,000 or less, and that’s most people, can use IRS Free File. Generally, taxpayers must complete their federal tax return before they can begin their state taxes. More than 20 states also have a state Free File program patterned after federal partnership which means many taxpayers are eligible for free federal and free state online tax preparation. Those states are: Arkansas, Arizona, Georgia, Idaho, Indiana, Iowa, Kentucky, Massachusetts, Michigan, Minnesota, Missouri, Mississippi, Montana, New York, North Carolina, North Dakota, Oregon, Rhode Island, South Carolina, Vermont, Virginia and West Virginia, plus the District of Columbia. In addition, IRS Free File partners – featuring 10 brand-name online products - offer most or some state tax returns for free as well. Some may also charge so it is important for taxpayers to explore their free options. Here’s how Free File works:

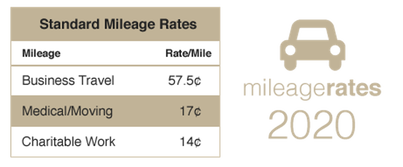

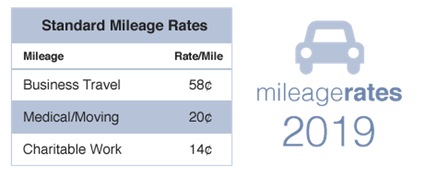

Free File partners will charge a fee for state tax return preparation unless their offer outlines upfront that you can file both federal and state returns for free. If you want to use one of the state Free File program products, go to your state tax agency’s Free File page. For residents of Alaska, Florida, Nevada, South Dakota, Texas, Washington and Wyoming, IRS Free File may be the only tax product you need. Those states do not have an income tax. "Tax Tips" are published to provide current tax information, tax-cutting suggestions, and tax reminders. If you would like more information on anything in "Tax Tips," or if you'd like to be on our mailing list to receive other tax information from time to time, please contact our office. The tax information contained in this site is of a general nature and should not be acted upon in your specific situation without further details and/or professional assistance. We are trusted CPA advisors servicing Burr Ridge, Hinsdale, Willowbrook, Darien, Naperville, and all Chicagoland area. Do you need assistance with your business and/or personal tax returns? Would you like to have a trusted source for your accounting, allowing you additional time to focus on increasing your business? Do you use QuickBooks, or plan to in the future, for your accounting? We include these in all our service packages, customized to fit your personal or business needs. We are currently accepting new clients. Your initial consultation is free, so you have nothing to lose and everything to gain. Our experienced staff is available to help you streamline your accounting, giving you more free time for yourself. Set up an appointment today by calling (630) 320-3720 or email us at [email protected]. For more free resources, such as Tax Rates, Tax Organizers, and Record Retention Schedules, access our website www.monarchaccountinggroup.com. Monarch Accounting Group, Inc 145 Tower Drive, Suite 4 Burr Ridge, IL 60527 Phone (630) 320-3720 Mileage rates for travel are now set for 2020. The standard business mileage rate decreases by 0.5 cents to 57.5 cents per mile. The medical and moving mileage rates also decreases by 3 cents to 17 cents per mile. Charitable mileage rates remain unchanged at 14 cents per mile. 2020 New Mileage Rates Here are 2019 rates for your reference, as well. Remember to properly document your mileage to receive full credit for your miles driven. "Tax Tips" are published to provide current tax information, tax-cutting suggestions, and tax reminders. If you would like more information on anything in "Tax Tips," or if you'd like to be on our mailing list to receive other tax information from time to time, please contact our office.

The tax information contained in this site is of a general nature and should not be acted upon in your specific situation without further details and/or professional assistance. We are trusted CPA advisors servicing Burr Ridge, Hinsdale, Willowbrook, Darien, Naperville, and all Chicagoland area. Do you need assistance with your business and/or personal tax returns? Would you like to have a trusted source for your accounting, allowing you additional time to focus on increasing your business? Do you use QuickBooks, or plan to in the future, for your accounting? We include these in all our service packages, customized to fit your personal or business needs. We are currently accepting new clients. Your initial consultation is free, so you have nothing to lose and everything to gain. Our experienced staff is available to help you streamline your accounting, giving you more free time for yourself. Set up an appointment today by calling (630) 320-3720 or email us at [email protected]. For more free resources, such as Tax Rates, Tax Organizers, and Record Retention Schedules, access our website www.monarchaccountinggroup.com. Monarch Accounting Group, Inc 145 Tower Drive, Suite 4 Burr Ridge, IL 60527 Phone (630) 320-3720 |

BLOGTo better serve our clients and friends, to keep you up-to-date and informed, our blog is a resource for tax tips and overall accounting related articles. We hope you find this useful! CATEGORIES

All

ARCHIVES

September 2023

|

|

Phone: (630) 320-3720

Monarch Accounting Group Inc 145 Tower Drive, Suite 10 Burr Ridge, IL 60527-7836 Email: [email protected] |

RSS Feed

RSS Feed