|

Every year is an election year when it comes to making decisions on your annual income tax return. Here are four common examples that can create tax savings opportunities if you elect the correct option.

1. Tax filing status. Typically, filing a joint tax return instead of filing separately is beneficial to a married couple, but not always! For instance, if one spouse has a high amount of medical expenses and the other doesn't, your total medical deduction may be greater filing separately due to the 7.5% of adjusted gross income (AGI) threshold before you can deduct these expenses. 2. Higher education expenses. Thanks to new legislation, many parents of college students again face a decision: Whether to take one of the two credits for higher education expenses or the tuition and fees deduction. The tuition and fees deduction, once expired, is now extended through 2020. To complicate matters, the credits and the deduction are all phased out based on different modified adjusted gross income (AGI) levels. Before you elect which tax benefit makes the most sense, you will need to evaluate all options. 3. Investment interest. Investment interest expenses can be deducted up to the amount of net investment income for the year. This income does not usually include capital gains, because of favorable tax treatment of this type of gain. However, you can elect to include capital gains to help you deduct your interest expense. You can even cherry-pick which capital gains to use for this deduction. If you take this election you forego the favorable tax rate for long-term gains. 4. Installment sales. If you sell real estate or other assets in installments over two or more years, the tax liability is spread over the years that payments are received. Thus, you may be able to postpone the tax due. This technique can reduce the total tax paid depending on your effective tax rate each year. However, you can also elect out of installment sale treatment by paying the entire tax in the year of the sale. You may wish to take this election if your income is lower in the year of the sale. Thankfully there is help navigating these key tax elections. Simply call with any questions. "Tax Tips" are published to provide current tax information, tax-cutting suggestions, and tax reminders. If you would like more information on anything in "Tax Tips," or if you'd like to be on our mailing list to receive other tax information from time to time, please contact our office. The tax information contained in this site is of a general nature and should not be acted upon in your specific situation without further details and/or professional assistance. We are trusted CPA advisors servicing Burr Ridge, Hinsdale, Willowbrook, Darien, Naperville, and all Chicagoland area. Do you need assistance with your business and/or personal tax returns? Would you like to have a trusted source for your accounting, allowing you additional time to focus on increasing your business? Do you use QuickBooks, or plan to in the future, for your accounting? We include these in all our service packages, customized to fit your personal or business needs. We are currently accepting new clients. Your initial consultation is free, so you have nothing to lose and everything to gain. Our experienced staff is available to help you streamline your accounting, giving you more free time for yourself. Set up an appointment today by calling (630) 320-3720 or email us at [email protected]. For more free resources, such as Tax Rates, Tax Organizers, and Record Retention Schedules, access our website www.monarchaccountinggroup.com. Monarch Accounting Group, Inc 145 Tower Drive, Suite 4 Burr Ridge, IL 60527 Phone (630) 320-3720

0 Comments

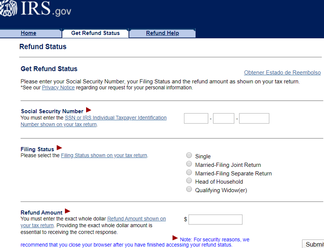

WASHINGTON — Offering time-saving alternatives to a telephone call, the Internal Revenue Service reminds taxpayers they can get fast answers to their refund questions by using the “Where’s My Refund?” tool available on IRS.gov and through the IRS2Go app. The IRS issues nine out of 10 refunds in less than 21 days, and the fastest way to get a refund is to file electronically and choose direct deposit. The time around Presidents Day is a peak period for telephone calls to the IRS, resulting in longer than normal hold times for callers. The question most frequently asked this time of year is, “Where’s my refund?”. The IRS reminds taxpayers that IRS customer service representatives can only research a refund’s status if it has been 21 days or more since the taxpayer filed electronically or six weeks since they mailed a paper return. Taxpayers can avoid the Presidents Day rush and get a personalized answer by using the “Where’s My Refund?” tool. All that is needed is the taxpayer’s Social Security number, tax filing status (single, married, head of household) and exact amount of the tax refund claimed on the return. Alternatively, taxpayers may call 800-829-1954 for the automated phone line, which provides the same information. Within 24 hours of filing a return electronically, the tool can tell taxpayers that their returns have been received. That time extends to four weeks if a paper return is mailed to the IRS, which is another reason to file electronically and choose direct deposit. Once the tax return is processed, “Where’s My Refund?” will tell a taxpayer when their refund is approved and provide a date when they can expect to receive it. “Where’s My Refund?” is updated no more than once every 24 hours, usually overnight, so taxpayers don’t need to check the status more often. Refunds held for certain returns As a reminder, by law, the IRS cannot release refunds for Earned Income Tax Credit or Additional Child Tax Credit tax returns before mid-February. “Where’s My Refund?” on IRS.gov and the IRS2Go app will be updated with projected deposit dates for most early Earned Income Tax Credit/Additional Child Tax Credit refund filers by Feb. 22. The IRS expects most EITC/ACTC related refunds to be available in taxpayer bank accounts or on debit cards by the first week of March, if they chose direct deposit and there are no other issues with their tax return. Taxpayers should check the “Where’s My Refund?” tool for their personalized refund date. Please note: Ordering a tax transcript will not speed delivery of tax refunds nor does the posting of a tax transcript to a taxpayer’s account determine the timing of refund delivery. Calls to request transcripts for this purpose are unnecessary. While the IRS still expects to issue more than nine out of 10 refunds in less than 21 days, it’s possible a particular tax return may require additional review and a refund could take longer. Many different factors can affect the timing of a refund. And, remember to take into consideration that many banks do not process payments on weekends or holidays and it can take time for a financial institution to post the refund to a taxpayer’s account or to receive it by mail. "Tax Tips" are published to provide current tax information, tax-cutting suggestions, and tax reminders. If you would like more information on anything in "Tax Tips," or if you'd like to be on our mailing list to receive other tax information from time to time, please contact our office. The tax information contained in this site is of a general nature and should not be acted upon in your specific situation without further details and/or professional assistance. We are trusted CPA advisors servicing Burr Ridge, Hinsdale, Willowbrook, Darien, Naperville, and all Chicagoland area. Do you need assistance with your business and/or personal tax returns? Would you like to have a trusted source for your accounting, allowing you additional time to focus on increasing your business? Do you use QuickBooks, or plan to in the future, for your accounting? We include these in all our service packages, customized to fit your personal or business needs. We are currently accepting new clients. Your initial consultation is free, so you have nothing to lose and everything to gain. Our experienced staff is available to help you streamline your accounting, giving you more free time for yourself. Set up an appointment today by calling (630) 320-3720 or email us at [email protected]. For more free resources, such as Tax Rates, Tax Organizers, and Record Retention Schedules, access our website www.monarchaccountinggroup.com. Monarch Accounting Group, Inc 145 Tower Drive, Suite 4 Burr Ridge, IL 60527 Phone (630) 320-3720 Often if you are in dire need for money the most tempting area to look is your IRA, 401(k), and other qualified retirement accounts. These funds, set aside for your retirement, may seem to be the answer to your financial woes.

Should I take an early withdrawal? Is it a good idea to tap into retirement account funds prior to reaching age 59½? Here are some things to consider:

If you still need to make the early withdrawal

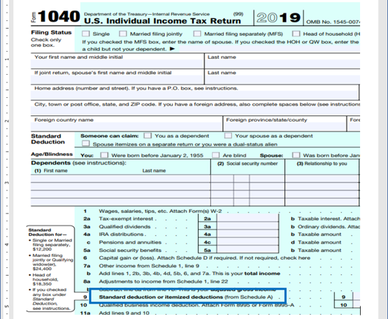

While it is never a great idea to tap into funds that are specifically set aside to make your retirement stress-free, if you must do so it is worth being thoughtful about how you go about the withdrawal. "Tax Tips" are published to provide current tax information, tax-cutting suggestions, and tax reminders. If you would like more information on anything in "Tax Tips," or if you'd like to be on our mailing list to receive other tax information from time to time, please contact our office. The tax information contained in this site is of a general nature and should not be acted upon in your specific situation without further details and/or professional assistance. We are trusted CPA advisors servicing Burr Ridge, Hinsdale, Willowbrook, Darien, Naperville, and all Chicagoland area. Do you need assistance with your business and/or personal tax returns? Would you like to have a trusted source for your accounting, allowing you additional time to focus on increasing your business? Do you use QuickBooks, or plan to in the future, for your accounting? We include these in all our service packages, customized to fit your personal or business needs. We are currently accepting new clients. Your initial consultation is free, so you have nothing to lose and everything to gain. Our experienced staff is available to help you streamline your accounting, giving you more free time for yourself. Set up an appointment today by calling (630) 320-3720 or email us at [email protected]. For more free resources, such as Tax Rates, Tax Organizers, and Record Retention Schedules, access our website www.monarchaccountinggroup.com. Monarch Accounting Group, Inc 145 Tower Drive, Suite 4 Burr Ridge, IL 60527 Phone (630) 320-3720  It’s a good idea for people to find out if they should file using the standard deduction or itemize their deductions. Deductions reduce the amount of taxable income when filing a federal income tax return. In other words, they can reduce the amount of tax someone owes. Individuals should understand they have a choice of either taking a standard deduction or itemizing their deductions. Taxpayers can use the method that gives them the lower tax. Due to tax law changes in the last couple years, people who itemized in the past might not want to continue to do so, so it’s important for all taxpayers to look into which deduction to take. Here are some details about the two methods to help people understand which they should use: Standard deduction The standard deduction amount adjusts every year and can vary by filing status. The standard deduction amount depends on the taxpayer’s filing status, whether they are 65 or older or blind, and whether another taxpayer can claim them as a dependent. Taxpayers who are age 65 or older on the last day of the year and don't itemize deductions are entitled to a higher standard deduction. Most filers who use Form 1040 or Form 1040-SR, U.S. Tax Return for Seniors, can find their standard deduction on the first page of the form. Taxpayers who can't use the standard deduction include:

Itemized deductions Taxpayers may need to itemize deductions because they can't use the standard deduction. They may also itemize deductions when this amount is greater than their standard deduction. Taxpayers who itemize file Schedule A, Form 1040, Itemized Deductions or Form 1040-SR, U.S. Tax Return for Seniors. A taxpayer may benefit by itemizing deductions for things that include:

Individual itemized deductions may be limited. Form 1040, Schedule A Instructions can help determine what limitations may apply. More information: Publication 501, Standard Deduction, and Filing Information How Much Is My Standard Deduction? Topic No. 551 Standard Deduction "Tax Tips" are published to provide current tax information, tax-cutting suggestions, and tax reminders. If you would like more information on anything in "Tax Tips," or if you'd like to be on our mailing list to receive other tax information from time to time, please contact our office. The tax information contained in this site is of a general nature and should not be acted upon in your specific situation without further details and/or professional assistance. We are trusted CPA advisors servicing Burr Ridge, Hinsdale, Willowbrook, Darien, Naperville, and all Chicagoland area. Do you need assistance with your business and/or personal tax returns? Would you like to have a trusted source for your accounting, allowing you additional time to focus on increasing your business? Do you use QuickBooks, or plan to in the future, for your accounting? We include these in all our service packages, customized to fit your personal or business needs. We are currently accepting new clients. Your initial consultation is free, so you have nothing to lose and everything to gain. Our experienced staff is available to help you streamline your accounting, giving you more free time for yourself. Set up an appointment today by calling (630) 320-3720 or email us at [email protected]. For more free resources, such as Tax Rates, Tax Organizers, and Record Retention Schedules, access our website www.monarchaccountinggroup.com. Monarch Accounting Group, Inc 145 Tower Drive, Suite 4 Burr Ridge, IL 60527 Phone (630) 320-3720  The last couple of years, the IRS has been penalizing late filers of S corporation and partnership tax returns. This, despite the fact that late filing of the tax returns (Forms 1120S and 1065), due March 15th, often does not impact the receipt of the taxes due on April 15th. Those that are getting this penalty are often couples and other small firms who have formed these business entities to provide legal protection for their shareholders. How much is the penalty? The penalty is calculated based on each partial month the return is late times the number of shareholders or partners. The fine is $205 per shareholder or partner per month. So a return filed 17 days late with no tax due could cost a married couple with an S corporation $820 in penalties! What you need to know If you have an S corporation or other partnership, either file an extension or submit your tax return on time. Remember, an extension gives you six months to file and you do not owe the tax until the flow-through tax return due date (typically April 15th). If you receive a penalty, challenge it. A well-worded request for reversal of the late filing penalty may be successful. Remember, the Treasury Department is still receiving the taxes owed to them on a timely basis. "Tax Tips" are published to provide current tax information, tax-cutting suggestions, and tax reminders. If you would like more information on anything in "Tax Tips," or if you'd like to be on our mailing list to receive other tax information from time to time, please contact our office. The tax information contained in this site is of a general nature and should not be acted upon in your specific situation without further details and/or professional assistance. We are trusted CPA advisors servicing Burr Ridge, Hinsdale, Willowbrook, Darien, Naperville, and all Chicagoland area. Do you need assistance with your business and/or personal tax returns? Would you like to have a trusted source for your accounting, allowing you additional time to focus on increasing your business? Do you use QuickBooks, or plan to in the future, for your accounting? We include these in all our service packages, customized to fit your personal or business needs. We are currently accepting new clients. Your initial consultation is free, so you have nothing to lose and everything to gain. Our experienced staff is available to help you streamline your accounting, giving you more free time for yourself. Set up an appointment today by calling (630) 320-3720 or email us at [email protected]. For more free resources, such as Tax Rates, Tax Organizers, and Record Retention Schedules, access our website www.monarchaccountinggroup.com. Monarch Accounting Group, Inc 145 Tower Drive, Suite 4 Burr Ridge, IL 60527 Phone (630) 320-3720  Wondering why your tax return is not finished? Often the delay can come from one or two items that were overlooked and are needed to complete your tax return. Here are some of the most common: Missing Statements. This includes all W-2s and 1099s including any related to gambling winnings, income, interest, and mutual funds. Dependent conflict. You claim a dependent on your tax return, but your child claimed themselves as a dependent or an ex-spouse has already filed a tax return with the same dependent's social security number. Mismatched names. You recently got married, but did not change your name with the Social Security Administration. Missing deduction documentation. Common among them are; charitable contribution recap, medical expense documents, child-care forms, property tax forms, home sales records, pension statements, and retirement forms. Waiting for your review. You need to sign your tax return and/or return a signed Form 8879 saying your return is ready to file electronically. Receiving documentation late. The closer to the April filing deadline your documents are received, the greater the potential back log of return processing. In tax return processing (and receiving a refund), the early bird not only gets the worm, it also gets the worm faster. If a missing item is requested of you, the sooner you can provide the information the better. It always takes a bit more time to review your return after setting it aside for a missing item. "Tax Tips" are published to provide current tax information, tax-cutting suggestions, and tax reminders. If you would like more information on anything in "Tax Tips," or if you'd like to be on our mailing list to receive other tax information from time to time, please contact our office. The tax information contained in this site is of a general nature and should not be acted upon in your specific situation without further details and/or professional assistance. We are trusted CPA advisors servicing Burr Ridge, Hinsdale, Willowbrook, Darien, Naperville, and all Chicagoland area. Do you need assistance with your business and/or personal tax returns? Would you like to have a trusted source for your accounting, allowing you additional time to focus on increasing your business? Do you use QuickBooks, or plan to in the future, for your accounting? We include these in all our service packages, customized to fit your personal or business needs. We are currently accepting new clients. Your initial consultation is free, so you have nothing to lose and everything to gain. Our experienced staff is available to help you streamline your accounting, giving you more free time for yourself. Set up an appointment today by calling (630) 320-3720 or email us at [email protected]. For more free resources, such as Tax Rates, Tax Organizers, and Record Retention Schedules, access our website www.monarchaccountinggroup.com. Monarch Accounting Group, Inc 145 Tower Drive, Suite 4 Burr Ridge, IL 60527 Phone (630) 320-3720 |

BLOGTo better serve our clients and friends, to keep you up-to-date and informed, our blog is a resource for tax tips and overall accounting related articles. We hope you find this useful! CATEGORIES

All

ARCHIVES

September 2023

|

|

Phone: (630) 320-3720

Monarch Accounting Group Inc 145 Tower Drive, Suite 10 Burr Ridge, IL 60527-7836 Email: [email protected] |

RSS Feed

RSS Feed