|

Your mailbox has started filling up with tax forms over the last several weeks and there are likely more to come. Getting your forms organized makes your tax filing easier for everyone involved. Here are some tips on how to handle all the forms you get and to head off any potential problems.

Collect them all Check last year's tax records, and make a list of the forms you received. Add any new accounts, employers or vendors and check the forms off as you get them. Gathering all your forms is important because the IRS gets copies of each form sent to them as well. Missing one can trigger an IRS correspondence audit, creating extra work and possibly delaying your refund. Check for digital forms More employers, banks and others are making their tax forms available to you electronically, so you may not get a paper form in the mail. Be sure to check your inbox for any missing forms before you file, and don’t forget to check your junk or spam email folders as well, just in case any tax information accidentally ends up there. Fix errors Double check to see if there are any errors on the forms you receive. If there are, contact the issuer via phone and in writing to get the problem fixed. If you can't get a corrected form, still report everything on your forms to the IRS, but add a correction explaining the error when you file your return. That way you can still file without waiting for the issuer to send you a corrected form. Commonly overlooked forms While getting all your W-2 and 1099 forms is important, there are three forms worthy of special attention before you file:

As you watch for your forms to arrive, remember to reach out to schedule your tax filing appointment. An early appointment will help ensure you get all questions answered ahead of the April filing deadline. "Tax Tips" are published to provide current tax information, tax-cutting suggestions, and tax reminders. If you would like more information on anything in "Tax Tips," or if you'd like to be on our mailing list to receive other tax information from time to time, please contact our office. The tax information contained in this site is of a general nature and should not be acted upon in your specific situation without further details and/or professional assistance. We are trusted CPA advisors servicing Burr Ridge, Hinsdale, Willowbrook, Darien, Naperville, and all Chicagoland area. Do you need assistance with your business and/or personal tax returns? Would you like to have a trusted source for your accounting, allowing you additional time to focus on increasing your business? Do you use QuickBooks, or plan to in the future, for your accounting? We include these in all our service packages, customized to fit your personal or business needs. We are currently accepting new clients. Your initial consultation is free, so you have nothing to lose and everything to gain. Our experienced staff is available to help you streamline your accounting, giving you more free time for yourself. Set up an appointment today by calling (630) 320-3720 or email us at [email protected]. For more free resources, such as Tax Organizers, and Record Retention Schedules, access our website www.monarchaccountinggroup.com. Mia Verc, CPA; Janice Papais, CPA

0 Comments

When it makes sense to file a tax return as soon as you canThe 2022 tax filing season officially begins when the IRS starts accepting tax returns in late January and early February. There are many reasons to consider filing your tax return as soon as the IRS begins accepting returns. Here are some of the most common:

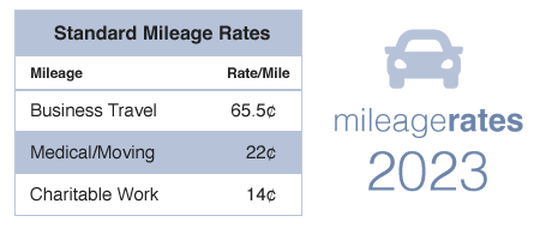

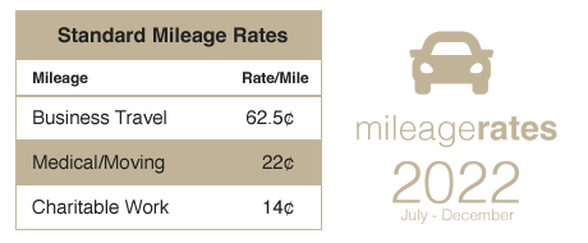

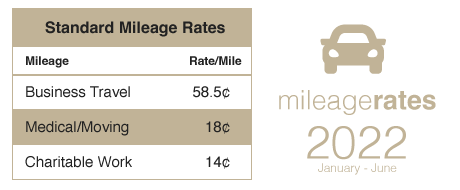

To get your refund. There's no reason to let the government hold onto your funds interest-free, so file early and get your refund as soon as possible. While legislation delays receiving refunds for tax returns claiming The Earned Income Credit and the Additional Child Tax Credit until after February 15th, the sooner your tax return is in the queue, the sooner you will receive your refund. To minimize your tax identity fraud risk. Once you file your tax return, the window of opportunity for tax identity thieves closes. Tax identity thieves work early during the tax filing season because your paycheck's tax withholdings are still in the hands of the IRS. If they can file a tax return before you do, they may be able to steal these withholdings via a refund that should have gone to you! To avoid a dependent dispute. One of the most common reasons an e-filed return is rejected is when you submit a dependent’s Social Security number that has already been used by someone else. If you think there is a chance an ex-spouse may do this, you should file as early as possible. To deliver your return to someone who needs it. If you are planning to buy a house or anticipate any other transaction that will require proof of income, you may wish to file early. This is especially important if you are self-employed. You can then make your filed tax return available to your bank or other financial institution. To beat the rush. As the tax filing deadline approaches, the ability to get help becomes more difficult. So get your documentation together and schedule a time to get your tax return filed as soon as you can. It can be a relief to have this annual task in the rear-view mirror. "Tax Tips" are published to provide current tax information, tax-cutting suggestions, and tax reminders. If you would like more information on anything in "Tax Tips," or if you'd like to be on our mailing list to receive other tax information from time to time, please contact our office. The tax information contained in this site is of a general nature and should not be acted upon in your specific situation without further details and/or professional assistance. We are trusted CPA advisors servicing Burr Ridge, Hinsdale, Willowbrook, Darien, Naperville, and all Chicagoland area. Do you need assistance with your business and/or personal tax returns? Would you like to have a trusted source for your accounting, allowing you additional time to focus on increasing your business? Do you use QuickBooks, or plan to in the future, for your accounting? We include these in all our service packages, customized to fit your personal or business needs. We are currently accepting new clients. Your initial consultation is free, so you have nothing to lose and everything to gain. Our experienced staff is available to help you streamline your accounting, giving you more free time for yourself. Set up an appointment today by calling (630) 320-3720 or email us at [email protected]. For more free resources, such as Tax Organizers, and Record Retention Schedules, access our website www.monarchaccountinggroup.com. Mia Verc, CPA; Janice Papais, CPA New mileage rates announced by the IRSMileage rates for travel are now set for 2023. The standard business mileage rate increases by 3 cents to 65.5 cents per mile. The medical and moving mileage rates stay at 22 cents per mile. Charitable mileage rates remain unchanged at 14 cents per mile. 2023 New Mileage Rates Here are the 2022 mileage rates for your reference. July 2022 through December 2022 January 2022 through June 2022 Remember to properly document your mileage to receive full credit for your miles driven.

"Tax Tips" are published to provide current tax information, tax-cutting suggestions, and tax reminders. If you would like more information on anything in "Tax Tips," or if you'd like to be on our mailing list to receive other tax information from time to time, please contact our office. The tax information contained in this site is of a general nature and should not be acted upon in your specific situation without further details and/or professional assistance. We are trusted CPA advisors servicing Burr Ridge, Hinsdale, Willowbrook, Darien, Naperville, and all Chicagoland area. Do you need assistance with your business and/or personal tax returns? Would you like to have a trusted source for your accounting, allowing you additional time to focus on increasing your business? Do you use QuickBooks, or plan to in the future, for your accounting? We include these in all our service packages, customized to fit your personal or business needs. We are currently accepting new clients. Your initial consultation is free, so you have nothing to lose and everything to gain. Our experienced staff is available to help you streamline your accounting, giving you more free time for yourself. Set up an appointment today by calling (630) 320-3720 or email us at [email protected]. For more free resources, such as Tax Organizers, and Record Retention Schedules, access our website www.monarchaccountinggroup.com. Mia Verc, CPA; Janice Papais, CPA The tax filing season is a popular time for scammers to call and try to dupe unsuspecting taxpayers. These thieves often make threatening or alarming calls posing as the IRS to try to steal taxpayer money or personal information.

However, it’s easy for people to recognize this scam by knowing how the IRS contacts taxpayers. The IRS will never:

Taxpayers who receive these phone calls should:

More information: Tax Scams and Consumer Alerts Report Phishing and Online Scams Share this tip on social media -- #IRSTaxTip: Taxpayers should hang up if tax season scammers come calling. http://ow.ly/XSuC50Mk6BT "Tax Tips" are published to provide current tax information, tax-cutting suggestions, and tax reminders. If you would like more information on anything in "Tax Tips," or if you'd like to be on our mailing list to receive other tax information from time to time, please contact our office. The tax information contained in this site is of a general nature and should not be acted upon in your specific situation without further details and/or professional assistance. We are trusted CPA advisors servicing Burr Ridge, Hinsdale, Willowbrook, Darien, Naperville, and all Chicagoland area. Do you need assistance with your business and/or personal tax returns? Would you like to have a trusted source for your accounting, allowing you additional time to focus on increasing your business? Do you use QuickBooks, or plan to in the future, for your accounting? We include these in all our service packages, customized to fit your personal or business needs. We are currently accepting new clients. Your initial consultation is free, so you have nothing to lose and everything to gain. Our experienced staff is available to help you streamline your accounting, giving you more free time for yourself. Set up an appointment today by calling (630) 320-3720 or email us at [email protected]. For more free resources, such as Tax Organizers, and Record Retention Schedules, access our website www.monarchaccountinggroup.com. Mia Verc, CPA; Janice Papais, CPA Late-breaking IRS changeIn a last minute about face, the IRS is rolling back the requirement for third-party payment providers to issue 1099-Ks for anyone receiving payments over $600 in 2022. They are moving the reporting requirement back to $20,000 in activity and 200 or more transactions as they transition to the lower threshold in 2023.

Why the change The bottom line? The IRS is not ready to figure out how to automate the auditing of those under-reporting their income from things like Ebay, Esty and Amazon sales or from sales of tickets and other goods through payment systems like Venmo and Ticketmaster. What does not change While this last-minute change may keep you from receiving a 1099-K this year, don’t count on it. Many providers are already geared up to send them out and will probably do so, since the IRS reprieve in reporting is temporary. So keep your eyes open for these forms throughout January and early February. While the IRS informational return reporting is temporarily changing, what is not changing is your requirement to report this income. So if you have activities that provide income to you, including your side hustle buying and selling event tickets, that activity is reportable on your tax return. Stay tuned In further developments, Congress is up to their old tricks in changing the rules at the end of the year. Preliminary review, of the yet unsigned bill, indicates the major changes will impact 2023 and beyond. So stay tuned, future tax tips will lay out the basic tax law changes and how you can take advantage of them. "Tax Tips" are published to provide current tax information, tax-cutting suggestions, and tax reminders. If you would like more information on anything in "Tax Tips," or if you'd like to be on our mailing list to receive other tax information from time to time, please contact our office. The tax information contained in this site is of a general nature and should not be acted upon in your specific situation without further details and/or professional assistance. We are trusted CPA advisors servicing Burr Ridge, Hinsdale, Willowbrook, Darien, Naperville, and all Chicagoland area. Do you need assistance with your business and/or personal tax returns? Would you like to have a trusted source for your accounting, allowing you additional time to focus on increasing your business? Do you use QuickBooks, or plan to in the future, for your accounting? We include these in all our service packages, customized to fit your personal or business needs. We are currently accepting new clients. Your initial consultation is free, so you have nothing to lose and everything to gain. Our experienced staff is available to help you streamline your accounting, giving you more free time for yourself. Set up an appointment today by calling (630) 320-3720 or email us at [email protected]. For more free resources, such as Tax Organizers, and Record Retention Schedules, access our website www.monarchaccountinggroup.com. Mia Verc, CPA; Janice Papais, CPA |

BLOGTo better serve our clients and friends, to keep you up-to-date and informed, our blog is a resource for tax tips and overall accounting related articles. We hope you find this useful! CATEGORIES

All

ARCHIVES

September 2023

|

|

Phone: (630) 320-3720

Monarch Accounting Group Inc 145 Tower Drive, Suite 10 Burr Ridge, IL 60527-7836 Email: [email protected] |

RSS Feed

RSS Feed