|

The time to organize your tax records is now. Informational tax information is hitting your regular and digital mailboxes from now until late March. To make matters worse, this year there are economic recovery payments, unemployment benefits, and advance child tax payment records to organize!

Here are some tips to get on top of your tax records. Organizational Hints If you have not already done so, create a folder for the current year’s files. Here are some filing suggestions.

The Digital Alternative If more of your records are in digital format, consider creating a tax folder for each year on your computer and then place your digital records into sub-folders using the same sort as noted above. Create password protection for each folder. Rotation idea Finally, at the end of each tax year place a note on the tax return to confirm the date your tax return was sent into the federal and/or state government. Note on the outside of this file when you can toss the support documentation. While you keep the tax return indefinitely, most documentation is safe to shred after 3 1/2 years. But do not take this action unless you are certain of the length of time you will need to save these records. "Tax Tips" are published to provide current tax information, tax-cutting suggestions, and tax reminders. If you would like more information on anything in "Tax Tips," or if you'd like to be on our mailing list to receive other tax information from time to time, please contact our office. The tax information contained in this site is of a general nature and should not be acted upon in your specific situation without further details and/or professional assistance. We are trusted CPA advisors servicing Burr Ridge, Hinsdale, Willowbrook, Darien, Naperville, and all Chicagoland area.

0 Comments

Taxpayers with dependents who don't qualify for the child tax credit may be able to claim the credit for other dependents. This is a non-refundable credit. It can reduce or, in some cases, eliminate a tax bill but, the IRS cannot refund the taxpayer any portion of the credit that may be left over.

Here’s more information to help taxpayers determine if they’re eligible to claim it on their 2021 tax return. The maximum credit amount is $500 for each dependent who meets certain conditions. These include:

A taxpayer can claim this credit if:

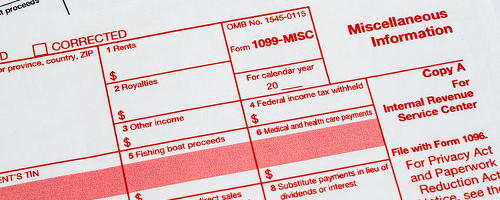

"Tax Tips" are published to provide current tax information, tax-cutting suggestions, and tax reminders. If you would like more information on anything in "Tax Tips," or if you'd like to be on our mailing list to receive other tax information from time to time, please contact our office. The tax information contained in this site is of a general nature and should not be acted upon in your specific situation without further details and/or professional assistance. We are trusted CPA advisors servicing Burr Ridge, Hinsdale, Willowbrook, Darien, Naperville, and all Chicagoland area. It is late February and you realize the Form 1099 you received is in error. In fact, it overstates your income by several thousand dollars. What should you do?

"Tax Tips" are published to provide current tax information, tax-cutting suggestions, and tax reminders. If you would like more information on anything in "Tax Tips," or if you'd like to be on our mailing list to receive other tax information from time to time, please contact our office The tax information contained in this site is of a general nature and should not be acted upon in your specific situation without further details and/or professional assistance. We are trusted CPA advisors servicing Burr Ridge, Hinsdale, Willowbrook, Darien, Naperville, and all Chicagoland area.

Tax laws are complicated but the most common tax return errors are surprising simple. Many mistakes can be avoided by filing electronically. Tax software does the math, flags common errors and prompts taxpayers for missing information. It can also help taxpayers claim valuable credits and deductions.

Using a reputable tax preparer – including certified public accountants, enrolled agents or other knowledgeable tax professionals – can also help avoid errors.

The IRS urges all taxpayers to file electronically and choose direct deposit to get their refund faster. IRS Free File offers online tax preparation, direct deposit of refunds and electronic filing, all for free. Some options are available in Spanish. Many taxpayers also qualify for free tax return preparation from IRS-certified volunteers. "Tax Tips" are published to provide current tax information, tax-cutting suggestions, and tax reminders. If you would like more information on anything in "Tax Tips," or if you'd like to be on our mailing list to receive other tax information from time to time, please contact our office. The tax information contained in this site is of a general nature and should not be acted upon in your specific situation without further details and/or professional assistance. We are trusted CPA advisors servicing Burr Ridge, Hinsdale, Willowbrook, Darien, Naperville, and all Chicagoland area. The IRS recently announced it will be sending out a recap of payments sent to taxpayers for the multiple rounds of Economic Impact Payments and Advanced Child Tax Payments. Here is what you need to know. Economic Impact Payments During 2021, the IRS issued millions of economic impact payments. In a recent announcement the IRS claims they will send Letter 6475 to all recipients of the money sent under these programs. Use this letter as a guideline to file your tax return. Letters are being sent out in late December and early January, so if you have not received yours, it should be coming shortly. Advance Child Tax Payments For the second half of 2021, the IRS paid out 50% of projected child tax credit payments to qualified households using their own formulations. Now the IRS is claiming they will be sending out a recap of those advance payments in Letter 6419 to account for them correctly on your tax return. As with the economic impact letters, you should receive yours in January. Required Action: Wait for the letter. If at all possible, do not file your tax return until you receive the appropriate letter(s). Then provide them with other documentation to prepare your tax return. Trust but verify. Do not assume the IRS letter is correct. Review your own records, ideally, prior to receiving the IRS letter(s). Keep BOTH the letters and confirmation of payments received. Both should be retained in your record keeping. File your tax return based on actual receipts. Do not wait too long. While it makes sense to wait for these IRS letters prior to filing, do not wait too long. If one is not received, file your tax return based on what you actually received. Clarity will help file a correct tax return. By providing both the letters AND documentation of actual payments, your tax return can not only be filed correctly, but can be filed in such a way that accurate reporting does not inadvertently create a computer generated audit from the IRS. "Tax Tips" are published to provide current tax information, tax-cutting suggestions, and tax reminders. If you would like more information on anything in "Tax Tips," or if you'd like to be on our mailing list to receive other tax information from time to time, please contact our office. The tax information contained in this site is of a general nature and should not be acted upon in your specific situation without further details and/or professional assistance. We are trusted CPA advisors servicing Burr Ridge, Hinsdale, Willowbrook, Darien, Naperville, and all Chicagoland area. It’s important for taxpayers to know the difference between standard and itemized deductions1/12/2022 Taxpayers have two options when completing a tax return, take the standard deduction or itemize their deductions. Most taxpayers use the option that gives them the lowest overall tax.

Due to all the tax law changes in the recent years, including increases to the standard deduction, people who itemized in the past might want to switch to the standard deduction. Here are some details about the two options. Standard deduction The standard deduction amount increases slightly every year and varies by filing status. The standard deduction amount depends on the taxpayer's filing status, whether they are 65 or older or blind, and whether another taxpayer can claim them as a dependent. Taxpayers who are age 65 or older on the last day of the year and don't itemize deductions are entitled to a higher standard deduction. Most filers who use Form 1040 can find their standard deduction on the first page of the form. The standard deduction for most filers of Form 1040-SR, U.S. Tax Return for Seniors, is on page 4 of that form. Not all taxpayers can take a standard deduction, which is discussed in the Instructions for Forms 1040 and 1040-SR. Those taxpayers include:

Itemized deductions Taxpayers choose to itemize deductions by filing Schedule A, Form 1040, Itemized Deductions. Itemized deductions that taxpayers may claim include:

"Tax Tips" are published to provide current tax information, tax-cutting suggestions, and tax reminders. If you would like more information on anything in "Tax Tips," or if you'd like to be on our mailing list to receive other tax information from time to time, please contact our office. The tax information contained in this site is of a general nature and should not be acted upon in your specific situation without further details and/or professional assistance. We are trusted CPA advisors servicing Burr Ridge, Hinsdale, Willowbrook, Darien, Naperville, and all Chicagoland area. Reminder: Fourth Quarter Estimated Taxes Now Due! Now is the time to make your estimated tax payment1/10/2022 The IRS started issuing information letters to advance child tax credit recipients in December. Recipients of the third round of the Economic Impact Payments will begin receiving information letters at the end of January. Using the information in these letters when preparing a tax return can reduce errors and delays in processing.

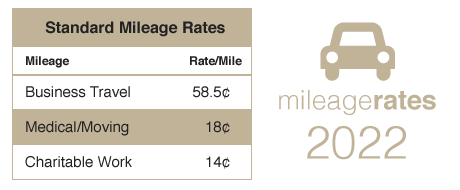

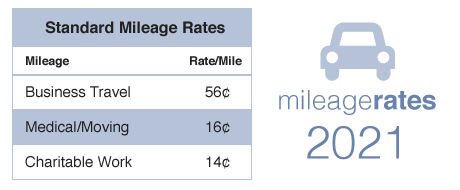

People receiving these letters should keep them. Do not throw them away. These letters can help taxpayers, or their tax professional prepare their 2021 federal tax return. Advance child tax credit payments letter can help people get remainder of 2021 credit To help taxpayers reconcile and receive all the 2021 child tax credits to which they are entitled, the IRS started sending Letter 6419, 2021 advance CTC, in late December 2021 and will continue into January. This letter includes the total amount of advance child tax credit payments taxpayers received in 2021 and the number of qualifying children used to calculate the advance payments. People should keep this and any other IRS letters about advance child tax credit payments with their tax records. Families who received advance payments need to file a 2021 tax return and compare the advance payments they received in 2021 with the amount of the child tax credit they can properly claim on their 2021 tax return. The letter contains important information that can make preparing their tax returns easier. People who received the advance payments can also check the amount of their payments by using the CTC Update Portal available on IRS.gov. Eligible families who did not receive any advance child tax credit payments can claim the full amount of the child tax credit on their 2021 federal tax return. This includes families who don't normally need to file a tax return. Economic Impact Payment letter can help people claim the 2021 recovery rebate credit The IRS will begin issuing Letter 6475, Your Third Economic Impact Payment, to EIP recipients in late January. This letter will help Economic Impact Payment recipients determine if they are entitled to and should claim the recovery rebate credit on their 2021 tax returns when they file in 2022. Letter 6475 only applies to the third round of Economic Impact Payments, which were issued in March through December of 2021. The third round of Economic Impact Payments, including "plus-up" payments, were advance payments of the 2021 recovery rebate credit that would be claimed on a 2021 tax return. Plus-up payments were additional payments the IRS sent to people who received a third Economic Impact Payment based on a 2019 tax return or information received from the Social Security Administration, Railroad Retirement Board or Veterans Affairs. Plus-up payments were also sent to people who were eligible for a larger amount based on their 2020 tax return. Most eligible people already received the payments. However, people who are missing stimulus payments should review information on IRS.gov to determine their eligibility and whether they need to claim a recovery rebate credit for 2020 or 2021. This includes people who don't normally need to file a tax return. The Economic Impact Payment letters include important information that can help people quickly and accurately file their tax return. "Tax Tips" are published to provide current tax information, tax-cutting suggestions, and tax reminders. If you would like more information on anything in "Tax Tips," or if you'd like to be on our mailing list to receive other tax information from time to time, please contact our office. The tax information contained in this site is of a general nature and should not be acted upon in your specific situation without further details and/or professional assistance. We are trusted CPA advisors servicing Burr Ridge, Hinsdale, Willowbrook, Darien, Naperville, and all Chicagoland area. Mileage rates for travel are now set for 2022. The standard business mileage rate increases by 2.5 cents to 58.5 cents per mile. The medical and moving mileage rates also increases by 2 cents to 18 cents per mile. Charitable mileage rates remain unchanged at 14 cents per mile. 2022 New Mileage Rates Here are the 2021 mileage rates for your reference. 2021 Mileage Rates Remember to properly document your mileage to receive full credit for your miles driven. "Tax Tips" are published to provide current tax information, tax-cutting suggestions, and tax reminders. If you would like more information on anything in "Tax Tips," or if you'd like to be on our mailing list to receive other tax information from time to time, please contact our office.

The tax information contained in this site is of a general nature and should not be acted upon in your specific situation without further details and/or professional assistance. We are trusted CPA advisors servicing Burr Ridge, Hinsdale, Willowbrook, Darien, Naperville, and all Chicagoland area. |

BLOGTo better serve our clients and friends, to keep you up-to-date and informed, our blog is a resource for tax tips and overall accounting related articles. We hope you find this useful! CATEGORIES

All

ARCHIVES

September 2023

|

|

Phone: (630) 320-3720

Monarch Accounting Group Inc 145 Tower Drive, Suite 10 Burr Ridge, IL 60527-7836 Email: [email protected] |

RSS Feed

RSS Feed